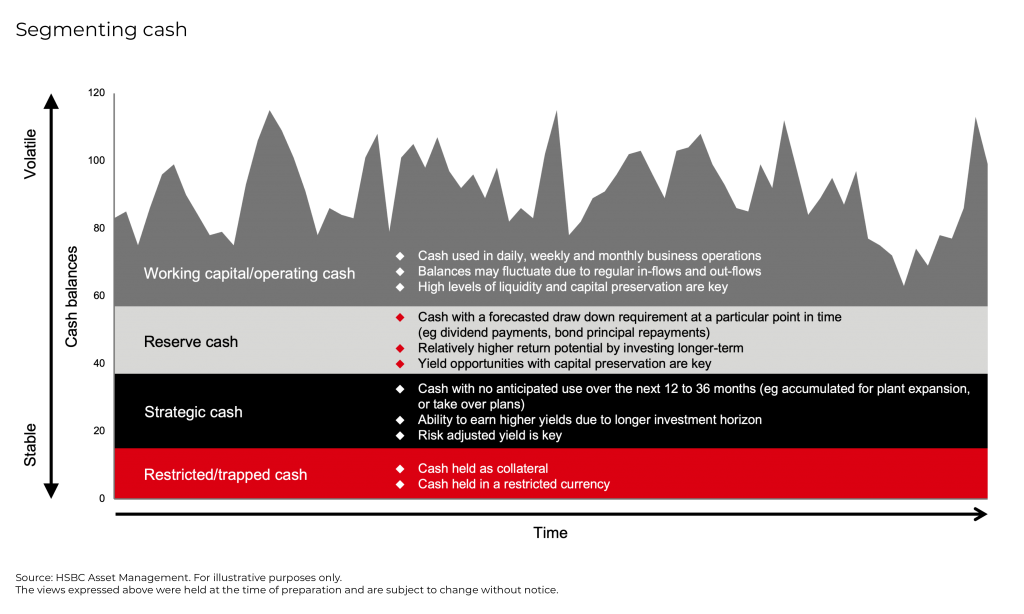

The most effective strategy incorporates a thorough investment policy, precise goals and parameters for liquidity, quality and return. Key to that process is cash segmentation, to clearly distinguish between operational, reserve and strategic cash and their respective investment horizons. By looking strategically at their cash, treasurers gain the ability to increase incremental returns, without materially increasing the risk profile.

Key practicalities

- Lead the way by expanding beyond the traditional cash management remit, by treasurers acting as cash-flow stewards for their companies; and

- Function as the financial asset managers for the company, investing spare cash that sits on the balance sheet, to generate a return by intelligently balancing yield, liquidity and security by assessing the true requirements for surplus liquidity and investing the balance.

Segmenting cash

The investment policy will guide the treasury function regarding cash segmentation, to ascertain how much of the portfolio is to be highly liquid, the levels of acceptable risk and respective investment horizons.

Effective cash segmentation has to start with a detailed cash forecast, to avoid any unnecessary risks being taken. The level of excess or shortfall of cash at various points in time, versus plan/baseline/zero balance, needs to be estimated to understand the period for which funds are available for other uses. With that knowledge, the treasurer can ascertain the percentage of the portfolio that needs to be immediately accessible. Ideally, the treasurer should try to gauge when and where surplus cash is held in the organisation, how much of it is available and for how long.

The COVID-19 pandemic and its aftermath is causing many new challenges for businesses and corporate treasurers. As a result of having drawn down on borrowing facilities for contingency purposes, some companies have maintained significantly higher cash balances than normal. Others will not have been so fortunate, experiencing a loss of business and difficultly in accessing sufficient borrowing schemes. In either case, the paradigm has shifted. The global economy has changed, and with that, the way business is done.

Deciding on how to segment cash, treasurers need to consider:

- The purpose of the cash;

- Respective time horizons;

- Corporate liquidity requirements;

- Return objectives;

- Tax and accounting issues;

- Any differences in application depending on jurisdiction or geography; and

- Frequency, process and ownership of any review process.

When making a decision regarding investing cash, it is important to consider the nature of the cash to be invested. Segmenting the different components of the surplus cash can result in an increased yield on a portfolio, which does not automatically sacrifice liquidity or security.

Cash segmentation strategies do not often change. However, given the significant disruption caused by the pandemic and the reassessment of business priorities that many companies are going through, it is important to either start to segment existing surpluses or review any existing segmentation rules and methodology.

- Operating cash

Operating cash is used to fund the organisation’s day-to-day needs and requires late-day/same-day liquidity. This cash may be invested in money market funds (MMFs), government or prime instruments. Bank obligations, treasuries and commercial paper are other solutions for operating cash requiring same-day liquidity. - Reserve cash

Reserve cash tends to be used for acquisitions, inventory build-up, share repurchase or R&D, as it does not require same-day liquidity. Because reserve cash requires limited liquidity, it can be invested over a horizon of six to 12 months, thereby capturing incrementally higher yields and returns than MMFs, while taking on only slightly greater risk and keeping a focus on preservation of principal. A strategy for reserve cash could have a portfolio duration of up to one year, investing in commercial paper, asset-backed securities and corporate bonds, among other securities. The maximum maturity for an individual security could be as much as three years. - Strategic cash

Surplus cash can accommodate even more limited liquidity and can be invested over a longer-term horizon. As surplus cash, with no identified short-term use, strategic cash can be invested over longer horizons of one to three years. The portfolio duration for short duration bond funds is 1.5 to 2.5 years; these funds can thus offer still-higher yields and returns than reserve funds, while controlling for risk and maintaining a focus on preservation of principal. Volatility is more noticeable, but while an investor may see deterioration in net asset values on a daily or even monthly basis, this would likely not be the case over longer time periods.

Short-term investment options

The short-term investment options described in the following section will be familiar for most major markets, but note: despite broadly general characteristics, there will be variations per country.

The various investment instruments can be grouped into three:

1. Governments and agencies;

2. Banks and financial institutions; and

3. Corporations.

Generally speaking, government-issued instruments are deemed to be the closest to the risk-free benchmark. The same can be said for highly rated financial institutions and corporations. By virtue of the greater regulation and control on banks, they are generally viewed as having lower risk than corporations.

Government issuers

Treasury bills (T-bills) are short-term (less than one year) debt instruments issued by a government and sold on a discount basis. Treasury bills are regarded as the most liquid of all money market instruments with the lowest risk, and thus command the lowest rate.

UK treasury bills: These are obligations of the British government issued by the UK Debt Management Office on a weekly basis by, and payable at, the Bank of England. In the primary market, treasury bills are issued at a discount to par for maturities of up to one year, although they typically do not exceed six months. They are considered a wholesale investment with a minimum investment of £500,000. They are issued in book form (ie transactions are recorded in a central registry and not issued physically).

US treasury bills: These are issued by the US government for maturities ranging from three months to one year and are considered virtually risk-free because they are backed by the ‘full faith and credit’ of the government. Unlike the UK bills, these are available in minimum denominations of $100, and in the primary market they are sold via Dutch auction on a discount basis in book form. They are very liquid, as there is an active secondary market, but the yields are low. T-bills are exempt from state and local income tax.

Note: A Dutch auction, also known as descending price auction, uses a bidding process that starts with a high price and continues to lower the price until all the available shares or units have been sold. Usually done on a sealed-bid basis, all buyers pay the same price.

Banks and other financial institutions

Banks and non-bank financial institutions offer a wide range of short-term instruments.

Overnight investment funds: In many markets, especially where interest is not paid on balances left in current accounts, banks offer an automatic overnight investment vehicle, which returns the funds to the account the next morning. Rates are usually low, and charges often apply for the service. In the US these are called sweep accounts.

Bank deposits: Also known as time deposits, these are fixed-term investments (one to six months) with interest payable at maturity. Bank deposits are not liquid and, in many countries, funds cannot be withdrawn before maturity or only with heavy penalties. The credit risk is that of the bank receiving the deposit.

Certificates of deposit (CDs) differ from time deposits principally in that they are negotiable, ie they can be bought and sold on the secondary market. In most markets these are issued in book form, thus a major consideration with CDs versus bank deposits is the need to be able to accept delivery in dematerialised form. In other words, the buyer of the CD (or their financial institution) would need to have an account with the custodian that holds the electronic records of the outstanding CDs in the market. This may entail additional custodial arrangements and costs.

Repurchase agreements: Commonly known as repos (or ‘reverse repos’ when viewed from the investor’s perspective) are short-term, often overnight, investment agreements. An investor (lender) agrees to purchase certain securities from the borrower and the borrower promises to repurchase the securities at a specified price and date. The return to the investor comes from the difference between the purchase price and the price at which the borrower buys back the securities. Repos are a form of fully collateralised borrowing by a bank or broker. Restrictions are usually placed on the securities that are used (often government-issued treasuries are used as a security against the borrowing) and counterparties involved. Third-party repos, where the counterparty’s custodian holds the securities but to the order of the lending party, are allowed, to enable late-day investments, when it would otherwise be too late to affect a transfer to the investor’s custodian.

Corporate instruments

Many higher-rated companies have found that they can borrow funds more cheaply by cutting out the banks and dealing directly with investors.

Commercial paper (CP): Short-term, unsecured promissory note, issued by a company and sold directly to investors under a CP programme, which will be rated by the rating agencies. CP is often issued on a revolving, renewable basis, but in the first instance is usually issued with maturities of 30 to 60 days – although it can be as short as one day or up to one year. CP is issued at a discount to its face value, and full face value is repaid at maturity. Investors obtain their return from the difference between the purchase price and redemption price.

USD CP: In the US the CP market is highly developed and a mainstay of the short-term money markets. Most highly rated companies in the US have active CP programmes. In order to avoid registration with the Securities and Exchange Commission in the US, commercial paper is usually issued for 270 days or less. The minimum denomination is $100,000. USD CP is usually quoted on a discount basis.

Euro CP (ECP): Issued to tap the international money markets and is denominated in a currency that differs from the corporation’s domestic currency, for example, USD CP issued by a UK company in London. Maturities range from one month to one year, but are mostly on the short-term side, under 180 days. Most ECP is issued on a discount basis.

Sterling/GBP CP: May be used by UK-based companies or financial institutions, using the market as a flexible way of raising short-term funds. Yields are similar to interbank deposit rates, depending on the credit rating of the issuer. The average term outstanding is under 30 days.

Floating rate notes: Another form of corporate debt that can be purchased is the floating rate note – a corporate promissory note with a variable interest rate. Maturity dates are set to coincide with when the interest rate is due to be re-set, usually every six months. The rate can also be tied to a certain money market index.

Ultra Short Duration Bond Funds (USBFs)

Treasurers with longer-term cash who are able to look down the credit-quality spectrum and further out in terms of maturity could consider Ultra Short Duration Bond Funds (USBFs) to pick up additional yield on strategic cash reserves for which the investment horizon is at least six to 12 months. Investors can take advantage of USDFs to provide additional income and total return potential, with a relatively low level of additional volatility.

Simply put, Ultra Short Duration strategies are the next step along the risk curve from a MMF, and take on additional interest-rate duration and credit risk beyond the constraints of a MMF. Fund solutions in this space are variable net asset value (VNAV), compared to the majority of MMFs, which (typically within the EU) are constant or low-volatility NAV.

While USBFs can typically invest in maturities out to three years, they aim to maintain a much shorter effective duration of six months or less, generally affording some protection against inflation. This ultra-short duration reduces the fund’s sensitivity to interest-rate fluctuations and comes with the added flexibility to invest opportunistically in maturities out to three years. These strategies can be delivered in pooled fund form or as segregated mandates set up to meet an individual investor’s specific requirements and guidelines

Money market funds

Money market funds (MMFs) are a form of mutual investment fund, which actively invest in a diversified portfolio of high-grade, short-term money market instruments and which are governed by the three fundamental principles of security, liquidity and yield (the SLY principle), in that order. Investors in a fund buy shares in the fund company and they earn a return regardless of share class type, not fund type, ie accumulating (reflected in the share price) or distributing (paid as dividend). There is no economic difference between the two.

MMF provides treasurers with an alternative to bank deposits for short-term cash. A typical MMF consists of low-risk, highly liquid instruments such as repos, commercial paper, certificates of deposit, bank deposits, floating-rate notes and medium-term notes.

The use of the term MMF varies significantly, especially between different markets, and has been used to describe funds with significantly different characteristics such as liquidity funds, which invest very short term (with a weighted average maturity less than about 90 days), and funds with extended terms, referred to as MMF plus or enhanced MMFs.

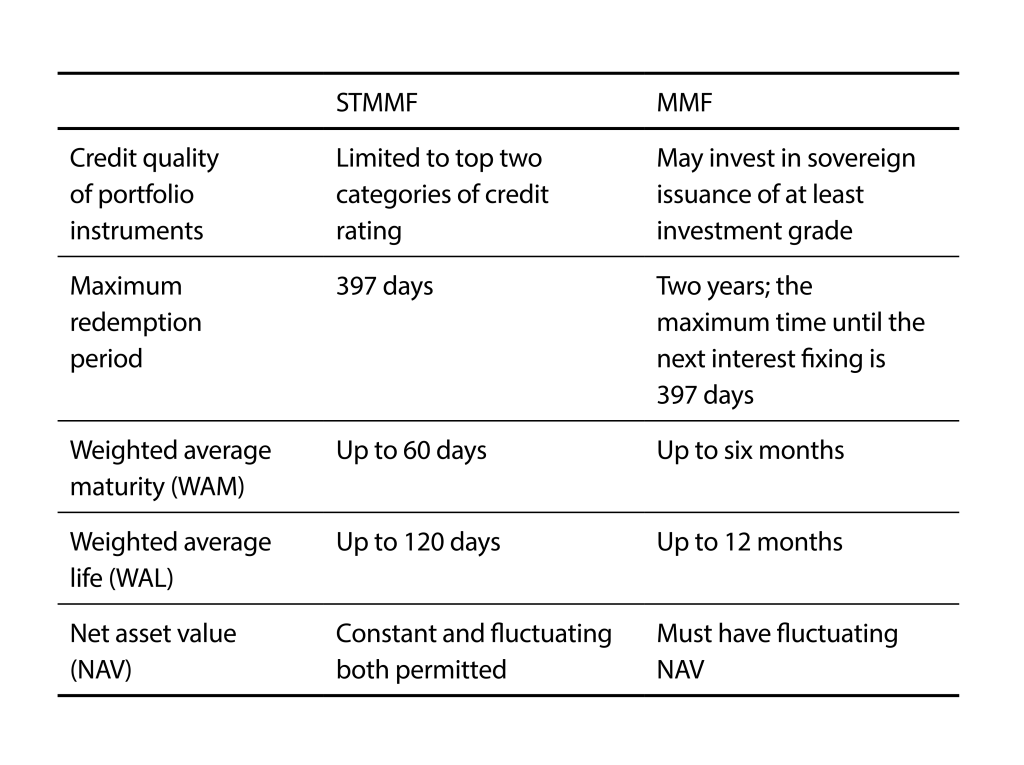

To clarify the terminology used when describing MMFs, the European Securities and Markets Authority (ESMA) has designated two categories of MMF: a short-term MMF (STMMF) and a MMF. The main differences between the two designations are listed below:

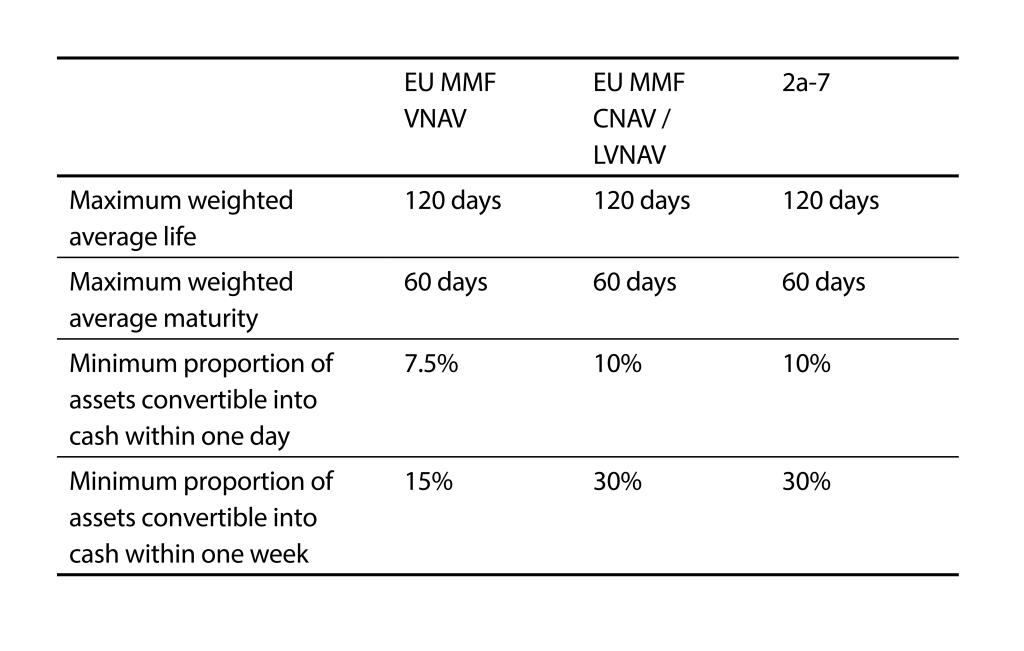

- CNAV funds use amortised cost accounting to value all of their assets. They aim to maintain a NAV, or value of a share of the fund, at €1/£1/$1 and calculate their price to two decimal places known as ‘penny rounding’. Most CNAV funds distribute income to investors on a regular basis (distributing share classes), though some may choose to accumulate the income, or add it on to the NAV (accumulating share classes). The NAV of accumulating CNAV funds will vary by the income received.

- VNAV funds use mark-to-market accounting to value some of their assets. The NAV of these funds will vary by a slight amount, due to the changing value of the assets and, in the case of an accumulating fund, by the amount of income received. This means that a fund with an unchanging NAV is, by definition, CNAV, but a fund with a NAV that varies may be accumulating CNAV or distributing or accumulating VNAV.

- LVNAV funds may use amortised cost accounting for assets up to 75 days while securities over 75 days must use mark-to-market or mark-to-model. Like CNAV funds, they aim to maintain a NAV or value of a share of the fund at €1/ £1/$1. A LVNAV fund can issue and redeem units at a NAV per share of 1.0 provided the value of the fund remains within 20 basis points of 1.00 per share. If this band is breached, a LVNAV fund has to be valued at NAV.

- Low-cost diversification: by using the pool of assets that the fund manager invests in, an investor is able to achieve a high degree of diversification of instruments, issuers, geographies and duration without the associated costs such as counterparty risk management and custody arrangements. In addition, treasurers can justify higher investment thresholds in MMFs than individual counterparties or instruments given the level of diversification within their funds.

- Low minimum investment: by pooling investments, MMFs can accept relatively small amounts that often are less than the minimum that an investor could invest in directly.

- Counterparty risk management: many funds are rated by global credit rating agencies (CRAs) (see below), which enable treasurers to report on this risk to their boards.

- Safety: the reforms (see below) have resulted in increased protection for investors. In the US, the 2a-7 rules place restrictions on the type and maturity of allowable investments. In Europe, a MMF must follow the guidelines from ESMA. In other countries there may be specific local rules or guidelines, and treasurers need to undertake appropriate research and seek local guidance.

Suitability

MMFs are most useful in the following situations:

- When there is a high degree of uncertainty over future cash flows that result in the need to hold significant amounts of liquidity on an overnight basis;

- As a counterparty risk management tool that delivers diversification;

- Where current accounts are not interest bearing;

- When higher-yielding instruments cannot be used for liquidity reasons;

- When exchange controls require local subsidiaries to invest locally, and alternative short-term instruments create unacceptable levels of risk; and

- As part of a strategy of managing the duration of the group’s overall investment portfolio within agreed limits.

Weighted average maturity (WAM) and weighted average life (WAL)

WAM and WAL are two commonly used metrics used to evaluate the positioning of a MMF. Regulators in both the US and Europe impose limits on the maximum WAM and WAL a fund may be managed to. In both jurisdictions a fund must not exceed a WAM of 60 days while WAL is limited to 120 days.

The WAM calculation is an indicator of a MMF’s maturity profile. The WAM of a fund is an average of the effective maturities of all securities, shown in days to maturity. For a fixed-rate security, the effective maturity is typically the same as the final maturity, whereas the effective maturity of a variable or floating rate securities is the number of days to the next coupon reset date, rather than to the final maturity. To calculate the WAM of a portfolio, each security’s weighting, as a percentage of the total portfolio, is multiplied by its effective maturity (measured in days) and these numbers are then summed.

By looking to a portfolio’s effective maturity, rather than final maturity dates, the WAM metric effectively captures a fund’s exposure to interest-rate movements and the potential price impact resulting from interest-rate movements. However, while this is a useful metric for interest-rate risk, it does not measure the risk of holding the securities until their final maturity.

The WAL calculation is based on the final maturity dates of the securities in a portfolio, and is also shown in days. By using the final maturity dates of the securities, WAL is an indicator of how a portfolio may react to deteriorating credit (widening spreads) or tightening liquidity conditions. To calculate the WAL of a portfolio, each security’s weighting, as a percentage of the total of the portfolio, is multiplied by its final maturity (measured in days) and these numbers are then summed.

Used together these metrics provide investors with transparency on how the fund is positioned from an interest rate and credit spread risk perspective.

Role of rating agencies

The majority of short-term MMFs are rated by one or more of the three main credit rating agencies (CRAs) – Standard & Poor’s, Moody’s and Fitch. Each rating agency has created a rating scale and criteria for MMFs, the highest rating being AAA, although the designations used are unique to the issuing agency; Standard & Poor’s uses the designation AAAm, Moody’s Aaa-mf and Fitch use AAAmmf.

Investors should take care to understand each agency’s approach to MMF rating. The agencies publish their rating criteria: in order to attract a particular rating, funds are restricted to investing in specific instruments and for maximum defined durations. In addition, the rating agency will examine the fund manager’s operational effectiveness and receive statements of assets as frequently as weekly, to check that the investment policy is being complied with. IMMFA has a useful guide to the approach these three CRAs adopt.