In the pursuit of an improvement in yield for longer-term cash holdings, beyond that provided by money market funds (MMFs), treasurers have access to various fixed-income investment options. The key is finding a suitable risk-adjusted strategy, where an increase in the yield for cash that can be locked away for longer is delivered without significantly increasing risk. Compared to other longer-term investment strategies, the case for Ultra Short Duration Bond Funds (USBFs) is compelling, demonstrating better risk-return characteristics than many other fixed-income strategies.

USBFs are open-ended bond funds that occupy the investment space between MMFs and Short Duration Fixed Income Bond Funds. “USBFs represent a strategy for many seasons, and aim to improve returns over MMFs for less liquid cash, without significantly increasing risk,” explains Andrew Dickinson, HSBC’s EMEA liquidity investment specialist.

USBFs provide investors with an interesting option. “An investment manager has the flexibility to use both securities seen in either MMFs or Short Duration Bond Funds, but more importantly can implement interest rate and credit strategies that could closely match either of these fund types,” says Dickinson.

The hybrid nature of USBFs means they can frequently deliver superior returns to MMFs, over longer investment horizons, under different credit and interest-rate environments, including periods of stress in financial markets or when interest rates are increasing.

Market performance

Due to the strong focus of USBFs on corporate bonds, a full investment grade, short-dated corporate bond index, such as a 0-1 year Corporate Index, can provide a good indication of the expected performance of an ultra-short duration strategy. Where held for six months or longer, analysis shows that USBFs frequently outperform MMF returns.

The same observation can be made in times of market stress. “In 2008, the BaML 0-1 year US Corporate Index outperformed all Prime USD Liquidity Funds, but also significantly outperformed the BaML 1-3 year US Corporate Index, while exhibiting less volatility,” confirms Dickinson, who adds: “Outperformance of Liquidity Funds has been the case for all years since 2006, including those periods of market stress, such as the global financial crisis in 2008, the European debt crisis in 2011 and the global coronavirus pandemic in 2020.”

The reason behind the improved performance is that an USBF invests in a series of short-maturity assets. “As with all investment strategies, avoiding defaults is key, so when a bond matures, those proceeds can be invested at current yields. In times of stress, yields can be rising quite rapidly, but with a stream of constant maturities an investment manager can continually reinvest at new high yields,” explains Dickinson.

With the prospect of rate increases, investors may wonder whether the timing for investment in USBFs is optimal. In the UK, for example, we have already seen rate increases, while in the US, the Federal Reserve looks set to increase rates a further six times this year, following an initial increase in March. However, as USBFs actively manage their investment exposures, they can offer investors some form of protection against rate hikes. USBFs can buy securities that are one year or more, or longer-dated Floating Rate Notes to protect against any rate increases. Indeed, the yield difference between a MMF and an USBF is the widest for more than a decade.

“Investing in an USBF now could potentially see significant performance benefits over a MMF, particularly if central banks do not deliver the full extent of the rate increases the market has priced in,” confirms Dickinson.

Diversification benefit

USBFs reflect market investment opportunities and as a result, USBFs in different currencies will often have different exposures. In sterling, for example, USBFs tend to hold more asset-backed securities, due to the lower number of corporate issuers in the market. In other currencies, such as euro or US dollar, exposure to corporate issues will be greater reflecting a broader and deeper market.

While most investors buy USBFs to improve returns for cash with a longer investment horizon, they also offer investors a means of diversification. Buying into an USF potentially provides a broader range of investments and a broader sector exposure, away from the financials typically held by MMFs. “One of the other advantages of an USBF is the diversification. Typically, liquidity funds hold around 80-90% in financial issuers, whereas an USBF would often have less than 50%. That means that investors are getting exposure to a different universe of issuers who don’t finance their operations using the types of securities that MMF managers are comfortable holding, such as commercial paper or certificates of deposit,” says Dickinson.

The US dollar market, being the broadest and deepest, offers the most diversification and can be accessed by sterling investors. “As a sterling investor, it is possible to access the US dollar market through buying a hedged share class of a US dollar USBF. This will remove currency risk and allow access to a whole range of corporate issuers that don’t issue in sterling. These include a wide range of investment-grade domestic US corporates, normally not accessible to sterling investors,” he adds. This broader and deeper market also helps in implementing any sustainable investment objectives that USBFs may have.

Characteristics of an USBF

Superior returns are typically delivered through a mix of longer-dated securities and lower-quality investment-grade investments. This additional interest rate and credit exposure, when managed appropriately, enables investors to improve their investment returns without materially increasing risk. Even though the majority of USBFs allow average maturities as long as 12 months, in order to effectively manage risk, this will frequently be managed to six months or less. Similarly, exposure to lower-rated securities will be actively managed, typically capping exposure to BBB-rated securities at 25% – often with no exposure permitted to the lowest investment-grade securities rated BBB-.

Notable characteristics

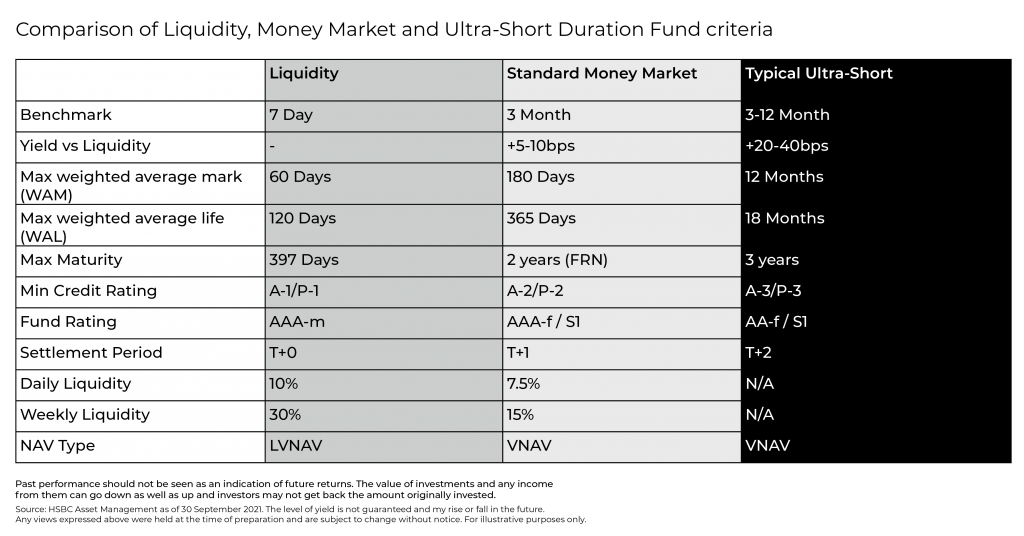

When comparing Liquidity Funds and USBFs, the key differences are:

- USBFs can invest in longer maturity securities, typically out to three years, and have longer average maturities.

- Exposure to low-quality investment-grade credit is probable, along with an overall greater exposure to credit reflected in a longer weighted average life.

- USBFs are bond funds that when seeking a fund rating will be assigned a bond fund rating. While the same designation (AAA, AA, A) is used for both bond funds and MMFs, it is important for an investor not to assume this means the same level of risk.

- USBFs are variable net asset value, hence influenced by mark-to-market prices creating an element of price volatility.

- Same-day settlement is not a feature of an USBF, with typical settlement periods of two days or longer.

- The investment horizon is longer for USBFs and not intended for daily cash flows.

- USBFs do not typically meet the IAS7 accounting definitions for cash and cash equivalents.

Which USBF is appropriate?

Obtaining an accurate sense of the USBF offering is challenging due to the fact that there is no regulatory definition for USBFs – unlike MMFs that are governed by a relatively narrow set of rules in Europe and the US. Varying interpretations of USBFs therefore exist in the market, with some funds exposed to maturities as long as five years, or to asset classes such as mortgage-backed securities.

Unfortunately, fund ratings are of little help for comparison purposes. An USBF is effectively a very short-dated bond fund where fund ratings are more focused on risk budgeting, with investment managers using that risk budget to meet the objectives of the fund. “There are many ways to use that risk budget,” explains Dickinson. “An investment manager could buy a significant amount of lower-quality investment-grade credit and balance that with exposure to government securities, while another investment manager may choose to focus exposure to high-quality AA or A-rated credit – both strategies would likely receive the same fund rating.”

Crucially, that means that comparing USBFs is not a simple case of comparing ratings, nor should the bond fund rating of an USBF be compared to the MMF rating of a Liquidity Fund.

As it comes down to the USBF manager to set the criteria, it is crucial that corporate treasurers undertake their own due diligence and look carefully at the investment objectives of the USBF, along with the respective risk characteristics.

USBF selection criteria

As they are not all equal, treasurers should consider the following when selecting an USBF:

- Maximum weighted average life of the fund to gauge the overall interest-rate exposure;

- Maximum maturity of any individual security to understand how that interest-rate exposure could be distributed;

- Minimum credit ratings allowed for any issuer;

- Maximum exposure to that rating to gauge the level of exposure to lower-quality credit; and

- The types of securities that are permissible, such as mortgage-backed or asset-backed securities.

A viable supplement to MMFs

Since the global financial crisis of 2008, USBFs have demonstrated their ability over longer investment horizons to frequently outperform Liquidity Funds and other MMFs. Selecting the right USBF is key and a treasurer should consider the selection criteria above and how they might fit into an investment policy designed for longer-term cash investments.

With interest rates rising, now is a good time for treasurers to review their investment strategies. While MMFs present a more secure and convenient cash-investment solution, USBFs represent a viable supplement for those treasurers who have successfully segmented their cash balances, where they can enjoy an improvement in return without taking a significant increase in interest rate or credit risk.

Andrew Dickinson is a liquidity investment specialist for HSBC Asset Management, where he has responsibility for engineering and delivering various strategically important product-development and growth initiatives. Andrew joined HSBC in 2018 and has worked in the asset management industry for more than 25 years. During this period, Andrew has worked as a portfolio manager, managing both fixed-income and money-market portfolios in various currencies; he has also been responsible for the leadership of the money-market businesses at both Credit Suisse and Aberdeen Asset Management.

Andrew holds a BA (Hons) degree in Economics and Computer Science from the University of the West of England.