This time last year, we noted the disruption and uncertainty markets faced throughout 2022, as a decade-long, low-interest rate policy regime ended abruptly and fears of a recession loomed. Fast forward, and 2023 has been no less ‘interesting’ a year

The last 12 months have highlighted the continued importance of having diversified and conservatively managed investment options such as money market funds (MMFs) in a treasurer’s toolkit. We have identified five key trends from 2023:

- Rates: while rising rates have put pressure on corporates needing to raise financing, they’ve provided opportunities for those with excess cash to invest, who have benefited from the highest yields in 15 years.

- ESG: treasurers continue to take a leading role in aligning practice with corporate sustainability goals.

- Disruption: MMFs have remained resilient in the face of market disruption throughout the year.

- Regulation: the European Commission has not proposed any changes to the existing MMF regulatory regime in its review, though it has noted areas that require further consideration.

- Parallel worlds: while the West has been raising rates, China has been cutting them in the face of slackening demand.

Rates

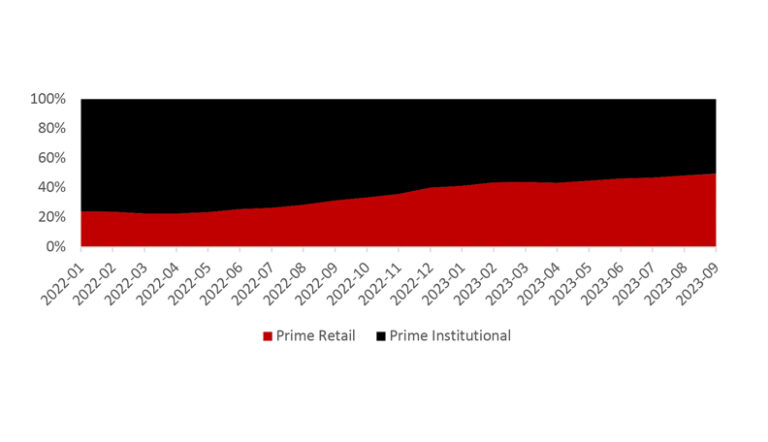

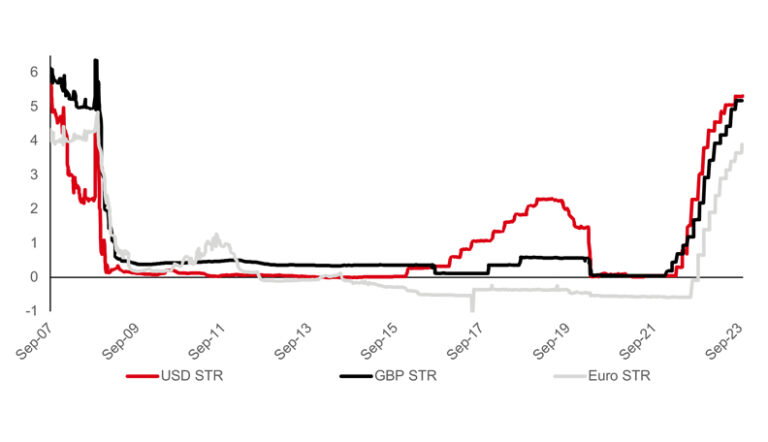

Rates in many currencies are now the highest they have been for the past 15 years, with barely a pause since central banks began hiking in 2022 until Q4 2023 (Figure 1). MMFs have seen positive inflows during the year in part due to attractive relative yields, and treasurers have also been increasing their term deposits, with the level of very short-term (e.g. overnight) bank deposits falling, for example in the eurozone. It is also interesting to note that in some markets – in addition to corporate treasury investors who continue to be typically the largest client type – retail and non-corporate institutional investors (such as hedge funds/pension funds) have increased their investment in MMFs as shown by the growing proportion of retail investors in US domestic prime funds (Figure 2).

Treasurers have taken advantage of these higher rates where balance sheets allow, but rising costs from supply chain issues, inflation, and higher refinancing costs have drained accumulated cash balances. For the cash that can stay on the balance sheet, there remains the opportunity for higher yields. Futures curves show a market predicting a ‘plateau’ in rates over the first part of 2024, with central banks keeping rates high to ensure inflation continues its downwards trajectory.

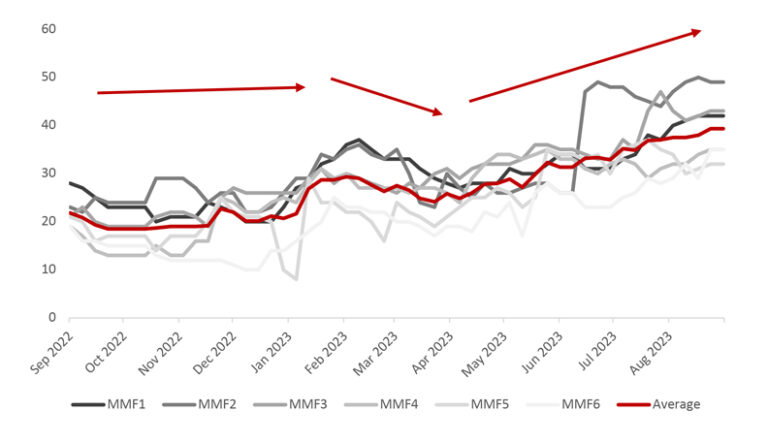

2023 presented a challenging market for investors and commentators alike to predict the path of rates, with data-dependent decisions driving a willingness to raise rates higher and faster than at times expected. At the beginning of the year, many MMFs began to extend their weighted average maturity (WAM) and weighted average life (WAL), but subsequently brought duration down, reflecting the continued upwards reforecasting of expected peak levels (Figure 3). An investment policy with a shorter WAM/WAL was rewarded as continuing rate hikes were quickly reflected in portfolio yield. Conversely, towards the end of 2023 there have been opportunities to extend duration with the peak in rates believed to have been reached but to remain ‘higher for longer’.

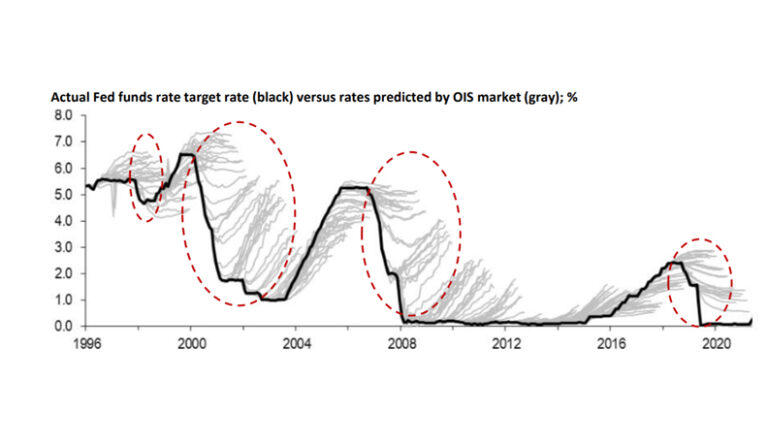

Markets have been poor predictors of future rate moves (Figure 4) and so we should examine the root causes of rate movements to formulate 2024’s outlook. With uncertainty remaining with the macroeconomic environment going into next year, we see two likely scenarios as we move into 2024:

- In the first, positive signals such as falling inflation and a buoyant US economy may lead central banks to slowly drop rates through 2024 to ensure that real rates remain constant as nominal rates fall with inflation. Central banks believe this the likely option, with the Fed predicting core PCE inflation of 2.6% in 2024, and a Fed Funds rate of 5.1% – a slight drop from 2023. This is the so-called ‘higher for longer’ scenario.

- In the second scenario, poor macroeconomic conditions cause central banks to cut rates.

There is a final scenario would see further rate increases, but this is unlikely to occur without resurgent inflation, which we don’t currently expect.

There is uncertainty over how central banks would react to poor macroeconomic conditions. Will they remain as steadfast in their promise to keep rates high until inflation reaches 2% when faced by a recession and rising unemployment? Their credibility is yet to be properly tested. How they react will reflect the central bank’s mandate and idiosyncratic local conditions; for example, the Bank of England and ECB’s mandates are for price and financial stability, whereas the Federal Reserve concerns itself with unemployment as well. Likewise, in the face of structurally higher inflation, the BoE may find itself mandate-bound to keep rates high despite worsening economic conditions, while at the same time the Fed would begin to unwind rates.

In both scenarios, treasurers will benefit as MMFs extend their WAM/WAL to capture the higher rates for as long as possible. These elevated rates and the flat yield curve provide opportunities for longer duration investment of strategic segmented cash, where available, to enhance yields further. The BoE is likely to keep rates elevated for the longest, followed by the ECB and then the Fed, who both have more room to manoeuvre.

ESG

Sustainability retains its place as a top treasury agenda item in 2023, and treasury functions are being recognised internally as areas of particular importance in both leading and enabling corporate sustainability efforts. This is reflected in the increasing ESG MMF AUM, which grew more than 50% in 2022 to total $939bn, a trend we have seen continue this year.

Treasurers are growing increasingly familiar with the tools at their disposal to invest cash more sustainably and increasingly use them to complement sustainable finance solutions. However, there exists significant divergence in the approaches of MMF managers to ESG investing and these differences must be understood by investors. Parallels between reliance on AAA MMF ratings and fund classification under the EU’s Sustainable Finance Disclosures Regulation are all too easy to draw with many investors unaware that the regulation is not a fund labelling regime in which minimum thresholds or standards must apply. Under EU SFDR, managers self-classify products based on internal definitions of sustainability that can vary significantly. As such, treasurers must be prepared to ‘look under the hood’ to understand the ESG investment process, the methodologies employed, and the market context the fund operates in. We have offered recent guidance on how treasurers can conduct manager due diligence – on ESG and other topics – to better understand how your current or prospective manager operates, which you can read here.

Disruption

The higher frequency of market events we have seen in recent years continued in 2023, and reminded treasurers of the importance of diversified, liquid securities, and the important role MMFs can play in fulfilling that need.

Several regional US banks defaulted or were purchased by a larger competitor, and we saw the emergency takeover of Credit Suisse (a Globally Systemically Important Bank) by UBS. For treasurers, it was a reminder of the importance of professional credit and counterparty risk analysis, even in the short-term credit market. Though depositors were protected and given swift access to their money this time, with preservation of capital the foremost priority for cash balances, there is no guarantee that regulators would extend the same beneficial treatment with the next crisis. You can find out more about analysing credit and counterparty risks here.

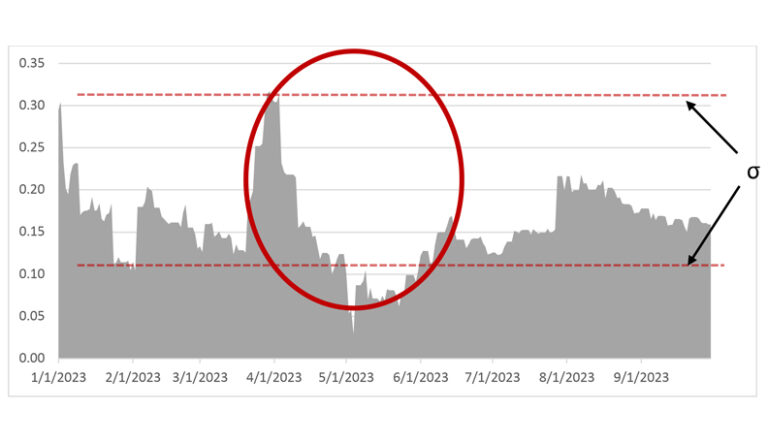

In June, meanwhile, the US government narrowly avoided a technical default, and the political risks surrounding this regular battle led Fitch Ratings to downgrade it from AAA to AA+. Both prime (including corporates) and government MMFs saw volatility as first government fund managers shortened WAM in April to before the expected default date, shortly followed by prime funds in May (Figure 5), all the while suppressing yields. However, once the debt ceiling had been raised, MMFs reverted to normal conditions and began lengthening WAMs again.

Regulation

The European Commission (EC) finally published its review of current MMF regulations in Europe, a report that was originally expected in summer 2022. It painted a positive picture of the resilience of European MMFs, as demonstrated by how they have weathered recent market crises. It identified some areas that should be further assessed, rather than suggesting any changes at this point, which we see as a positive outcome for investors.

The EC’s report followed the recent publication of the SEC’s revised rules for US-domiciled MMFs, which removed mandatory fees and gates, which were having the opposite of their intended effect by encouraging withdrawals, to be replaced discretionary liquidity fees. Alongside this, they increased the minimum daily and weekly liquid assets that should be held. These will come into effect over the next year.

In all, these recognise the success of previous regulatory efforts and of managers in navigating the complex markets of the past decade. As the positive macroeconomic conditions unwind, these regulations are likely to come under more frequent real-life stress testing. Regulators on both sides of the Atlantic are keen to ensure the ongoing stability of financial markets and that MMF regimes reflect this with appropriate amendments to maintain their resilience, preserving the utility of MMFs for investors and maintaining the flow of capital into the real economy.

The next phase in the regulatory debate surrounding MMFs is likely to be the publication of the Bank of England/Financial Conduct Authority consultation on potential reform of UK-domiciled MMFs. This will give stakeholders the opportunity to comment on various topics raised in the consultation paper.

Parallel worlds

Over the last decade, China has grown its economic importance in the global economy and continued to implement policies and reforms to open up its economy. In order to strengthen macro financial stability, Chinese authorities have also pushed forwards reforms to encourage RMB internationalisation, promoting usage of the RMB as a trading, financing and reserve currency. Its increasing global use is reflected in the value of RMB deposits held in offshore RMB hubs, which has also grown considerably over the last 10 years. Consistent with the rise of RMB for cross-border trade has been the increase in demand for more RMB cash management solutions offshore, including the launch of offshore RMB MMFs, which have resonated with investors with a focus on risk management.

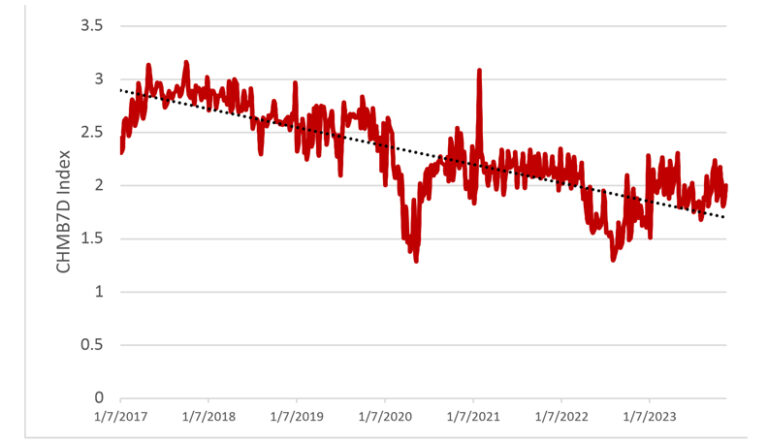

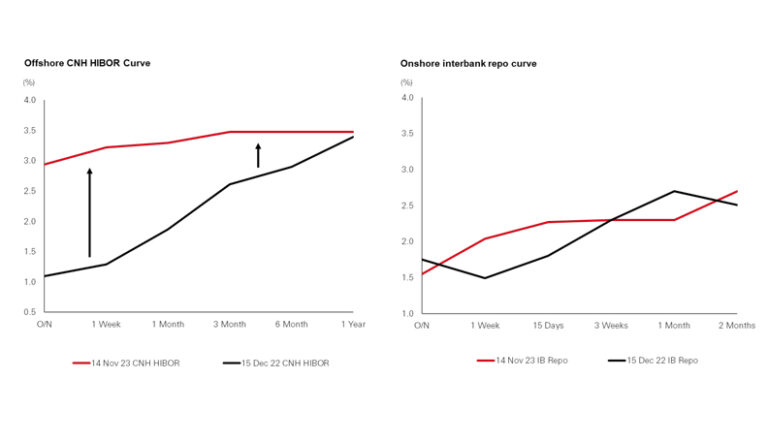

While the Western and most developing economies’ central banks have been raising rates amidst better-than-expected economic performance and high inflation, China has been doing the opposite. 2023 had been slated as a year of reopening, but high hopes were dashed as issues in the property market and poor consumer sentiment weighed upon the economy. As a result, the People’s Bank of China (PBOC) has dropped onshore rates throughout 2023, reflecting in the money markets (Figure 6). However, the offshore RMB rates have diverged as a result of support from the central bank and demand for RMB (Figure 7). You can find out more about the onshore RMB market here.

Targeted fiscal and monetary tools have been used to try to stimulate the economy. The government has fiscal room for more expansionary measures in spite of large off-balance sheet funding obligations and has already been using them. Starting in Q3 2023, the central government has announced fiscal stimulus that brought the budget deficit above the 3% of GDP threshold in order to support local government spending, alongside growing support for the property sector. Alongside this, further rate cuts are expected from the PBOC.

Looking back

In our round-up of 2022, we highlighted the potential for continued market volatility, haunted by the “spectre of recession” that has so far been avoided by most major economies. As 2023 draws to a close, we are reminded that new risks continue to emerge, underlining the need for robust credit and liquidity risk management frameworks and risks of overreliance on external credit ratings. Most notable, of course, were the March 2023 US regional banking crisis and takeover of Credit Suisse by UBS, quickly followed by the US debt-ceiling crisis.

We remain encouraged by the continued interest in ESG investment solutions among the treasury and wider MMF investor communities as the focus increasingly shifts to achieving more sustainable outcomes and reducing exposure to ESG risks. As regulators and investors increasingly demand higher levels of transparency and disclosures, combined with ever more ambitious corporate sustainability ambitions and commitments, this trend is likely to continue to accelerate.

Finally, while the European Commission has not made any firm proposals to change existing rules, we are nevertheless encouraged by its assessment of the functioning of the current rules and the resilience of MMFs as broadly positive, as we are the utility of Low Value Net Asset Value funds and the features that we know investors highly value. Meanwhile, clarity around changes to US regulations has brought certainty for investors and adequate time for the industry to adapt to changes that have been positively received.

We look forward to engaging with you throughout 2024, which no doubt will prove to be another eventful year!