Bank collapses in March 2023 brought the importance of credit analysis into sharp focus. Here, learn the fundamentals of bank credit analysis, which – when combined with investment guidelines – will offer a best-practice approach to mitigating credit risk

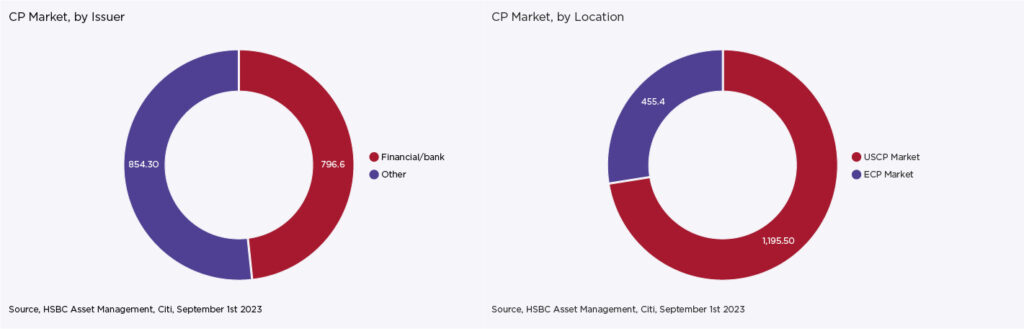

The high-quality, short-term credit market is used by treasurers – among other cash investors – either directly or indirectly through investment in money market funds (MMFs). This is a multi-trillion-dollar market comprised of more than 3,700 issuers, primarily highly rated banks.

However, not all high-quality credits are an equal credit risk and only through thorough fundamental analysis of individual issuers can risk be understood and differentiation achieved.

Corporate treasurers, who need to prioritise capital preservation and liquidity to ensure the company has resources available to meet its near term and strategic objectives, are not typically sufficiently resourced to carry out such thorough analysis of issuers – leaving them exposed to unquantified risks if they invest directly.

An investment in a professionally managed MMF gives efficient access to credit-research resource and market expertise few treasury functions can replicate, as well as the credit diversification and higher liquidity provided by a pooled investment vehicle.

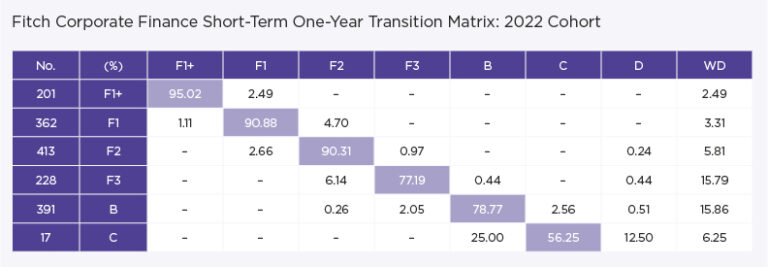

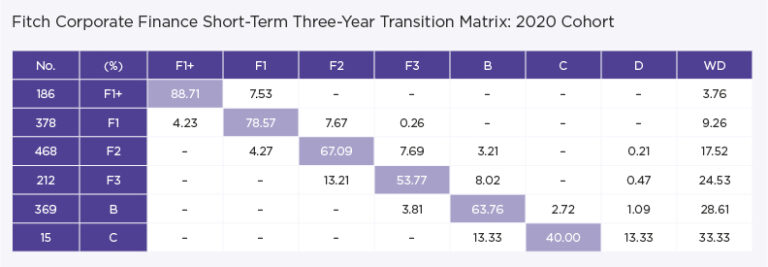

The matrices below show how short term issuers’ ratings have changed in the past year. To take the example of the 2022 cohort’s F1 universe, 90.88% of the 362 issuers have remained rated F1, 1.11% have moved up to F1+, 4.70% have moved down to an F2 rating, and 3.31% have withdrawn (no longer being rated by Fitch). This shows the importance of avoiding investing in weaker issuers, which could subject the investor to a forced sale at a discounted price.

Bank collapses in March 2023 demonstrated the importance of credit analysis. Though the disruption to the banking sector was limited in scale, with only a handful of banks going under, it included a global systemically important bank – Credit Suisse. As depositor or investor in any of these institutions, one assumes exposure to the risk of failure and the losses that could be sustained in a bank failure. Any decline in the creditworthiness of an issuer will impact both the liquidity and price of the investment and could also lead to contagion in other institutions. As previously described, the risks associated with a bank failure can be mitigated by thorough expert credit analysis covering a range of factors that are as relevant to cash investing as depositing with financial institutions.

CAMEL analysis

The basis for investigating and judging bank credits rests on CAMEL analysis, pioneered by US regulators in the late 1970s, which provides a framework to evaluate the creditworthiness of a bank. CAMEL analysis breaks down into five factors:

- Capital adequacy

- Asset quality

- Management and governance

- Earnings quality

- Liquidity

1. Capital adequacy

Why measure: Banks, by design, are uniquely highly leveraged institutions. This measure seeks to understand if a bank has sufficient capital to absorb unexpected losses.

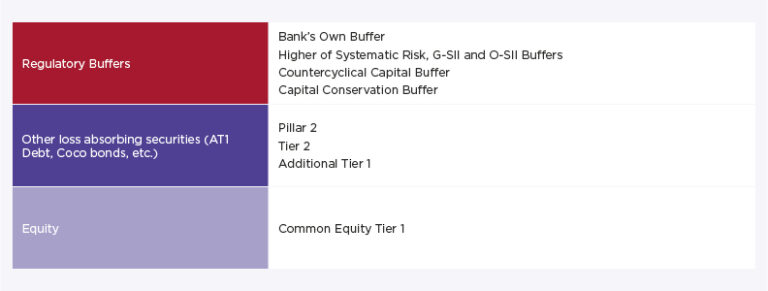

What’s measured: ‘Capital’ includes the debt and equity instruments that can be utilised to recapitalise a bank in the event of a failure. The simplest measure is equity/assets, but it takes no account of how risky those assets are; risk-weighting the assets provides greater clarity.

2. Asset quality

Why measure: Banks’ assets and liabilities are the inverse of a customer’s – your cash is a liability your bank will eventually repay. The quality of the assets banks hold, primarily in the form of loans and investments, is a measure of the credit risk they are taking on. A higher asset quality will provide more protection for holders of bank paper, particularly during macroeconomic downturns when credit events are more frequent.

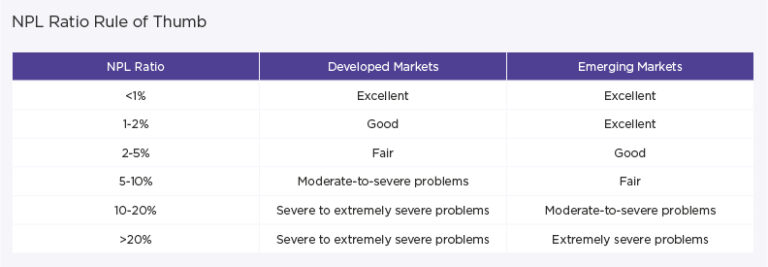

What’s measured: Banks set aside money in a loan loss reserve (LLR) to account for the expected credit loss of non-performing loans (NPL), typically those more than 90 days delinquent. Comparing the volume of NPL, which banks report, with the total size of their loan book will give a good idea of its credit quality. A comparison between LLRs and provisions (stock and flow measures respectively) will give insight to how the bank is managing any issues with credit quality in their loan book. A bank with adequate reserves to cover problematic assets could be viewed as having sound asset quality despite elevated NPL levels.

NPLs are a lagging measure and LLRs can be subject to management’s discretion. As such, a thorough analysis would interrogate management’s assumptions and evaluate emerging risks, including exposure to sectors of concern.

3. Management and governance

Why measure: Issues with management are often the root cause of other, more directly threatening, signs. SVB’s failure to hire a risk manager for the year prior to its collapse, succession challenges at First Republic, and the large (implicit) bets both made on interest rates staying low were governance and management red flags.

What to measure: A qualitative factor, analysts must understand both internal controls and risk management at a bank plus the soundness of the underlying business strategy. This includes a bank’s governance structure, culture, and risk management framework.

4. Earnings quality

Why measure: To continue as a going concern, a company needs to generate profit. How it does so will inform how sustainable those earnings are. Earnings that are either riskier, less diversified, or less efficient will be of worse quality and imply a riskier investment.

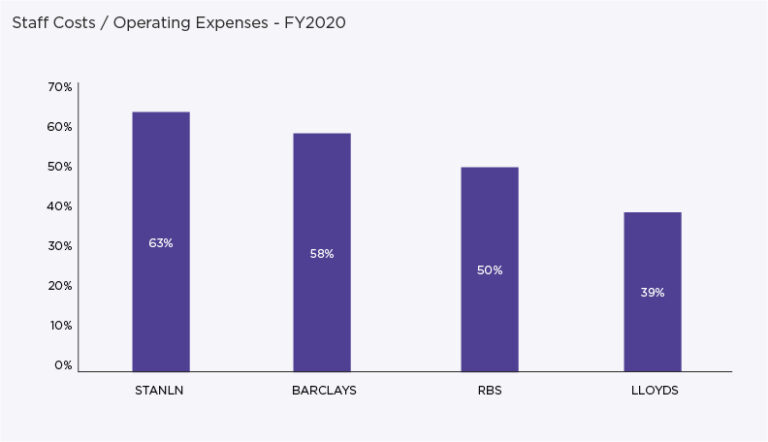

What’s measured: There are three main categories of efficiency ratios:

- Return-type ratios: This includes return on equity (ROE), return on assets (ROA), and return on risk-weighted assets (RORWA). ROA measures how effectively the bank’s assets are being managed to generate revenues.

- Margin-type ratios: Primarily net interest margin (NIM), which compares the net interest income on assets with the cost of liabilities. A high NIM is generally better, but investors must take care that an elevated NIM is not due to riskier lending.

- Cost-type ratios: This includes the cost-income and cost-asset ratios. As the names suggest, they compare the bank’s running costs (salaries, rents, fines, etc.), with either income or asset levels to assess how much a bank’s overheads are impacting its profitability.

5. Liquidity

Why measure: Whatever a bank’s underlying other fundamentals, a bank’s liquidity will determine whether it withstands a bank run. Ensuring a bank can meet redemptions and other obligations is key to continuing solvency.

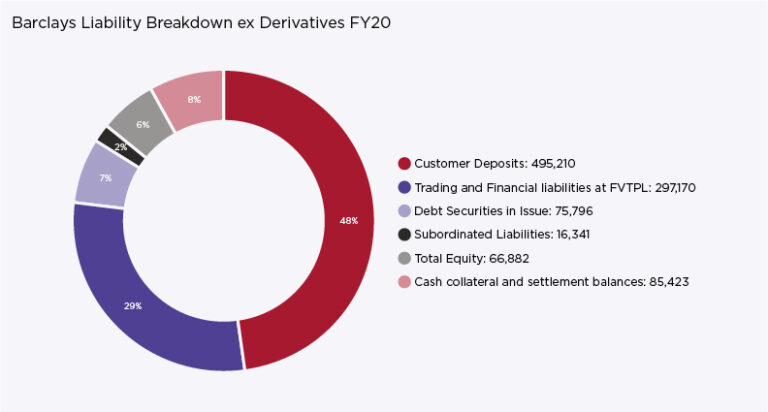

What’s measured: A number of regulatory stress tests measure whether banks have sufficient liquidity during periods of market stress. The liquidity coverage ratio compares the amount of high-quality liquid assets with stressed outflows during these periods, while the net stable funding ratio measures the stability of a bank’s funding over the coming year. Alongside this, analysts must track a bank’s funding sources such as customer deposits (the most stable and lowest cost), loans, and equity – with deposits the most valuable contributor to the ratio of the three.

Other factors

Several other factors must be analysed besides these fundamentals. These include the outlook for the banking sector, the regional economic outlook reflecting a bank’s exposure, the global macroeconomic outlook, regulations, and the competitive environment. Alongside this, a bank’s exposure to emerging risks not covered in sufficient details elsewhere should be investigated.

ESG cash investing

Alongside the above, issuers’ commitment and advancement in sustainability and climate-related objectives should be evaluated across the three factors of environmental, social and governance. By integrating considerations for ESG performance within the credit-assessment process – a methodology referred to as ESG Integration – risks arising from ESG factors can be identified, measured, and managed, potentially mitigating risks that an issuer may not have the capacity and willingness to meet financial commitments. However, the implementation of responsible investment methodologies such as ESG Integration is largely inaccessible to corporate treasurers since, unlike credit ratings, ESG scores and other sustainability metrics are costly. Internal expertise and a wide selection of specialist providers are required to build a rounded picture. The use of ESG Integration is increasingly commonplace within MMFs and a handful of providers offer dedicated ESG MMF solutions that place a greater emphasis on investing in issuers identified as being among the highest ESG performing issuers within the investible universe.

How does fundamental credit analysis drive investment decision-making?

A credit analyst will use the analysis outlined above as the basis for a proprietary credit rating creating a distinction between the highest-rated issuers. Best practice is then to combine this credit analysis with investment guidelines – which define maximum duration and size of investment in an issuer as well as minimum diversification requirements – to produce a diversified, high-quality portfolio of securities with maturities laddered to provide natural liquidity to investors. For example, it would be appropriate to scale the maximum size of an investment in an issuer to avoid owning significant proportions of their outstanding debt and limit the duration of exposure based on analysis of an individual issuer.

Treasurers looking to invest in the short-term credit market must be confident that either they or their fund manager are adequately managing bank credit risk, rather than taking A-1/P-1 ratings at face value. Similarly, treasurers utilising MMFs should not over-rely on AAA fund ratings that do not distinguish between fund managers’ approach to managing key risks. Indeed, these principles apply equally to considerations of where to place and maintain deposits. While the banking industry is among the safest sectors to invest in, and historically provided with an uncommon degree of government support, there are still risks that must be understood to be avoided in order to achieve security of capital, liquidity, diversification together with better risk adjusted returns by comparison to other traditional treasury instruments.

Interested in hearing more?

Watch this webinar and hear experts from HSBC Asset Management discuss the critical aspects of evolving credit risk and offer valuable insights into the tools and strategies available to help treasurers navigate these challenges effectively.