Essential rundown of the key fundamentals impacting investment decision-making for corporate treasurers in China, along with the specifics of the various investment instruments available.

Concise guide for corporate treasurers investing in China

China’s financial markets are less than 20 years old with the first MMF launched in 2003. The market has grown significantly with an Alibaba-linked fund being the world’s largest MMF at one point reaching $268bn in March 2018 before AUM fell back modestly as a consequence of regulation and fund manager action to reduce individual investor concentrations.

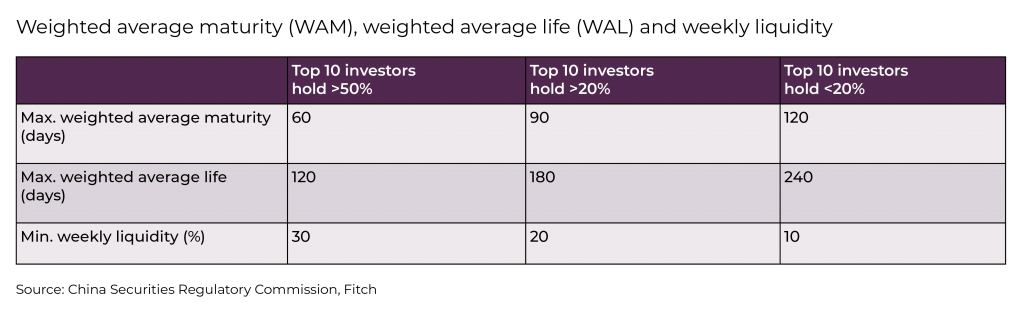

Retail investors make up approximately 60% of the domestic MMF investor base overall, with much of the growth attributable to the accessibility of funds via mobile technology. The exponential growth of MMFs combined with the high proportion of retail investors has prompted the CSRC and PBoC to reform regulation covering MMFs to improve transparency and protect investors, in particular placing limits on lower-quality assets and requiring greater levels of liquidity. The development of regulations is expected to extend towards interest rate and liquidity risk, and to apply new rules in relation to counterparty and credit risk.

As ever, an understanding of the local market and the risk profile of funds is essential for the corporate treasurer, particularly since there are further regulatory moves planned for 2022 to reduce systemic financial risks by encouraging diversification across both end investors and distribution channels.

For multinational companies operating in China, a notable feature is the difficulty around repatriating cash. As it’s complicated and potentially costly for corporate treasurers to move cash offshore, having a treasury policy that accommodates the use of MMFs and understanding the domestic market for MMFs is all the more important. This is particularly important since MMFs run by domestic and international providers typically have very different risk profiles, with domestic providers being more return driven and retail centric.

MMFs comprised 37.3% of China’s mutual funds by AuM at the end of 2021, down from a high of 67% at the end of the first quarter of 2018. This reflects both an increased level of regulation, but also an increase in the overall size of the investment market, which authorities have been keen to support with preferential policies to encourage the development of the domestic mutual funds industry. This includes a tax exemption on dividends generated by funds, including MMFs.

The domestic MMF industry is predominantly made up of prime market funds, which are almost entirely senior debt funds and based on the constant net asset value model. There are six funds that operate as variable net asset value, but these represent less than 1% of the market.

Diverging from international MMF norms, only a small proportion of China’s MMF industry is rated by a credit rating agency. Currently, Fitch is the only international rating agency to assign ratings to Chinese MMFs of which there are just three, with a combined AuM of ¥114bn as of April 2022. However, a MMF rating in China is unique and designed to specifically serve the needs of the domestic market, and the rating is denoted with a country-level suffix ‘AAAmmf (chn)’.

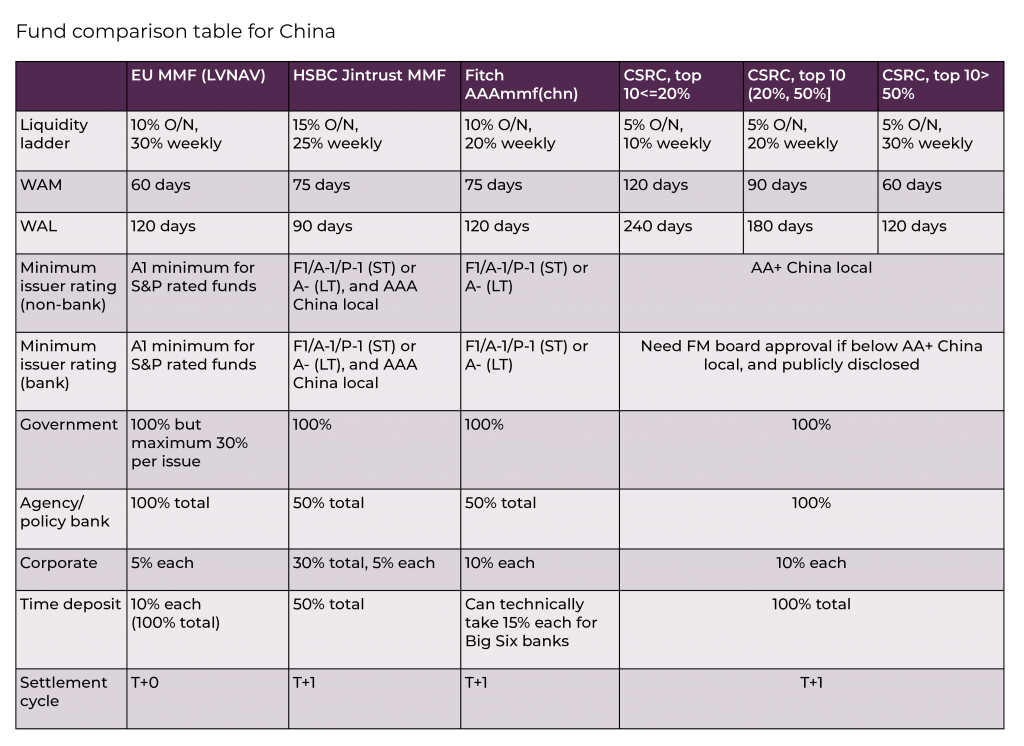

Corporate treasurers will need to be aware of variances between the rating criteria of Chinese MMFs and international alternatives they may be more familiar with. For example, while Fitch’s rating criteria limits Chinese MMFs to 75 days weighted average maturity (WAM) versus the regulatory maximum of 120 days, it remains higher than the maximum 60 days WAM by which international alternatives are constrained.

The market is quite concentrated with the top 10 fund managers accounting for some 47% of the industry by AuM at the end of 2021.

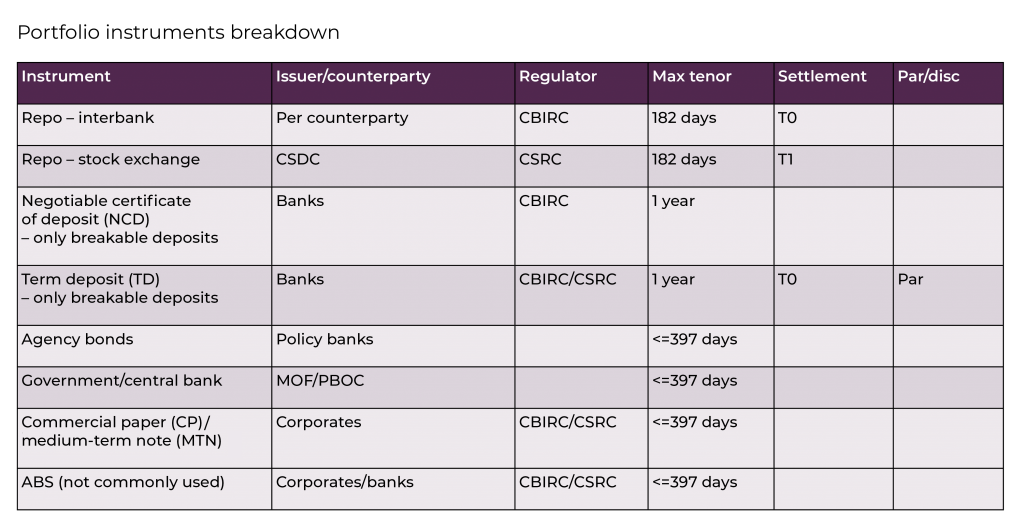

China has a broad market in terms of investment instruments. In addition to MMFs, there is a thriving interbank and exchange-traded repo market. There are also: agency bonds (which are policy bank bonds); central bank bonds; commercial paper issued by state-owned enterprises and by corporates; medium-term notes; time deposits; and standard certificates of deposit.

Corporate treasurers will need to consider whether or not their existing global policies can accommodate the risk characteristics of domestic Chinese funds and, if not, to what extent the policies may need to be extended. The extent to which the policies need to be more accommodative may also influence manager selection, since the risk profiles of funds run by international fund providers – which target institutional investors – are typically lower than those of domestic funds, which are geared to retail investors. Critical to manager selection is an understanding of the investment philosophy of a particular fund manager and how this translates into risk management.

Investors should consider:

Overall, it will be incumbent on corporate treasurers to apply sound due-diligence practices to manager selection, which should also consider operational risk, particularly given the relatively young nature of the market.

Custodians and distribution channels would need to set aside a minimum of 20% of their fees as a risk reserve.

According to Fitch, the added costs could lead fund providers to cap fund sizes and/or investor numbers, potentially leading to the introduction of new funds, to accommodate demand.

ESG is currently not a significant focus among investors in domestic Chinese MMFs. However, from a bond market perspective the PBoC and CSRC are beginning to look at ESG issues, in the wake of China’s statement that it will be net carbon-neutral by 2060. Focus and activity in this space are therefore likely to increase and, as domestic investors’ sentiment towards ESG orientated solutions grows, so will the availability of solutions to meet demand.

While retail investors can take advantage of mobile investing and ‘one-click’ investments, the technology space is less appropriate for the corporate treasurer from a governance and controls perspective. The nature of the Chinese market and requirements around setting up joint ventures with entities in China have hindered the development of third-party platforms by established international providers. However, in most instances, fund managers have their own portals such as HSBC Jintrusts portal for institutional MMF investors. Similarly, domestic banks operate portals catering to banks and non-banking financial institutions operating locally, and there are a growing number of domestic third-party distribution-only portals available.

CIO – liquidity, Asia-Pacific | HSBC Asset Management (Hong Kong) Ltd

Gordon Rodrigues is the Chief Investment Officer for the Liquidity Business in A-Pac. Prior to that he was the Head of Asian Rates, FX and Liquidity in the Asian Fixed Income team within HSBC Asset Management in Hong Kong. He has been working in the financial industry since 1992. Rodrigues joined HSBC Global Markets, India in 1994 as a Treasury Sales Specialist covering Corporate and Institutional Clients and traded Credit Products on the Fixed Income Trading Desk from 1998-2002. Gordon moved to HSBC Asset Management India in 2002 to set up the Fixed Income Investment Team and headed the team till 2007 before relocating to Hong Kong.

Prior to joining HSBC, Rodrigues worked as a Foreign Exchange & Fixed Income Dealer at Merwanjee Securities in Mumbai. Rodrigues holds a Master’s degree in Finance and a Bachelor’s degree in Electronics Engineering, both from the University of Mumbai (India).