Introduction

An Ultra Short Duration Bond Fund (USBF) can present a viable solution for treasurers seeking to improve yield, reduce volatility of returns (versus Short Duration strategies) and diversify exposure away from banks and sovereigns, typically used in a money market fund (MMF). With the appropriate credit strategy, the right USBF can achieve these objectives, without significantly increasing risk. Following on in the USBF series, this second article will focus on the importance of credit in an USBF and the reasons why investors should carefully consider the credit risks, which need to be specifically managed to meet the objectives.

Credit is important in many types of fixed-income funds, but more so in an USBF that aims to reduce volatility and preserve capital over the medium term. In low interest rate environments, credit will deliver a large proportion of the overall fund yield, and although as interest rates increase, credit will deliver a smaller proportion of the overall yield, the credit element of an USBF will remain responsible for the majority of the improved yield over MMFs.

A treasurer’s credit strategy should consider default risk, credit and credit rating, migration risk and the potential impact of market or geopolitical events on credit, or particular sectors and holdings. “An appropriate credit strategy is key to meeting the objectives of an Ultra Short Duration Bond Fund and investors should consider carefully the types of credit exposures a fund may take and the sizing of those exposures,” explains Andrew Dickinson, HSBC’s EMEA liquidity investment specialist.

Default risk

Default risk relates to the possibility that an issuer is unable to meet their obligations, by not paying coupons or not repaying principle on the date of maturity. The default of an issuer can have a serious impact on the return of an USBF and can significantly compromise the aim to preserve capital over the medium term.

The risk of a default impacting a fund can be lowered by having effectively diversified exposures and focusing on high-quality investment-grade issuers, while limiting exposures to lower-quality investment-grade issuers.

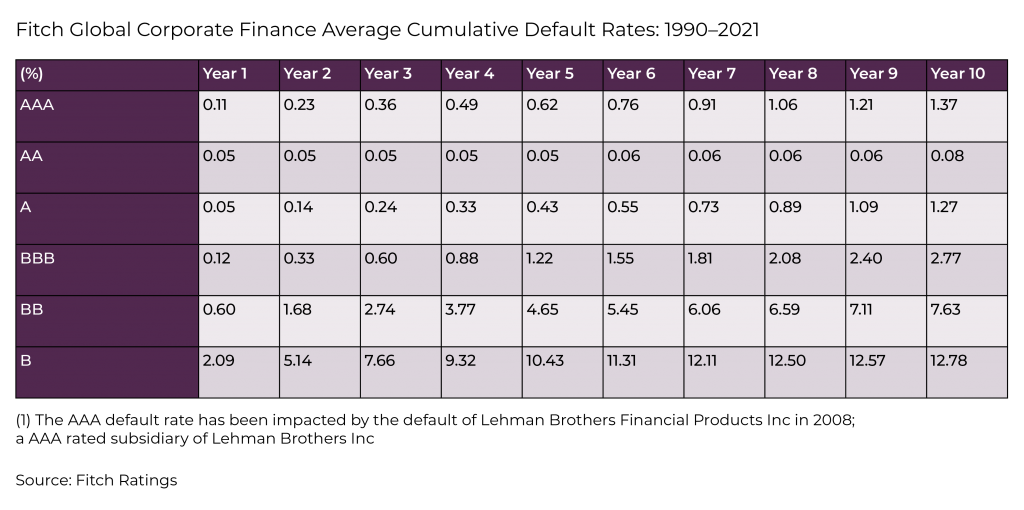

The table above shows the historical default rates for various ratings bands over a rolling one- to 10-year period between 1990 and 2021. As shown, it is clear that the probability of default for a AAA or AA is very low. However, it is also true that the probability of default of lower-quality investment grade is also relatively low and that default rates do not increase significantly until ratings move below BBB. Investors frequently view BBB- as the lowest credit rating, when in fact it is the lowest investment-grade credit rating that actually falls in the middle of the full rating spectrum. It is not until credits are rated BB or lower that rating agencies consider the credit risk to be speculative.

Dickinson therefore concludes: “The risk of default is low for all investment-grade credit, meaning BBB rated securities can be considered suitable investments for an Ultra Short Duration Bond Fund.” He goes on to say: “High exposures to BBB should still be avoided due to increased volatility of returns versus higher-quality investment-grade credit, which the default data does not reflect and, increased credit migration risk.”

Migration risk

Credit migration risk refers to the risk of a change in credit rating and, given the low default probabilities for investment-grade credit, is considered more important when managing overall volatility in an USBF. Aside from systemic risk, the risk of downgrade is one of the main sources of potential credit volatility. Key for the treasurer is the focus on the possibility of downgrades that have the potential to introduce volatility, rather than upgrades to credit quality. Managing volatility from migration risk, or other sources, is essential in an USBF, which is why many funds have average maturities of less than six months.

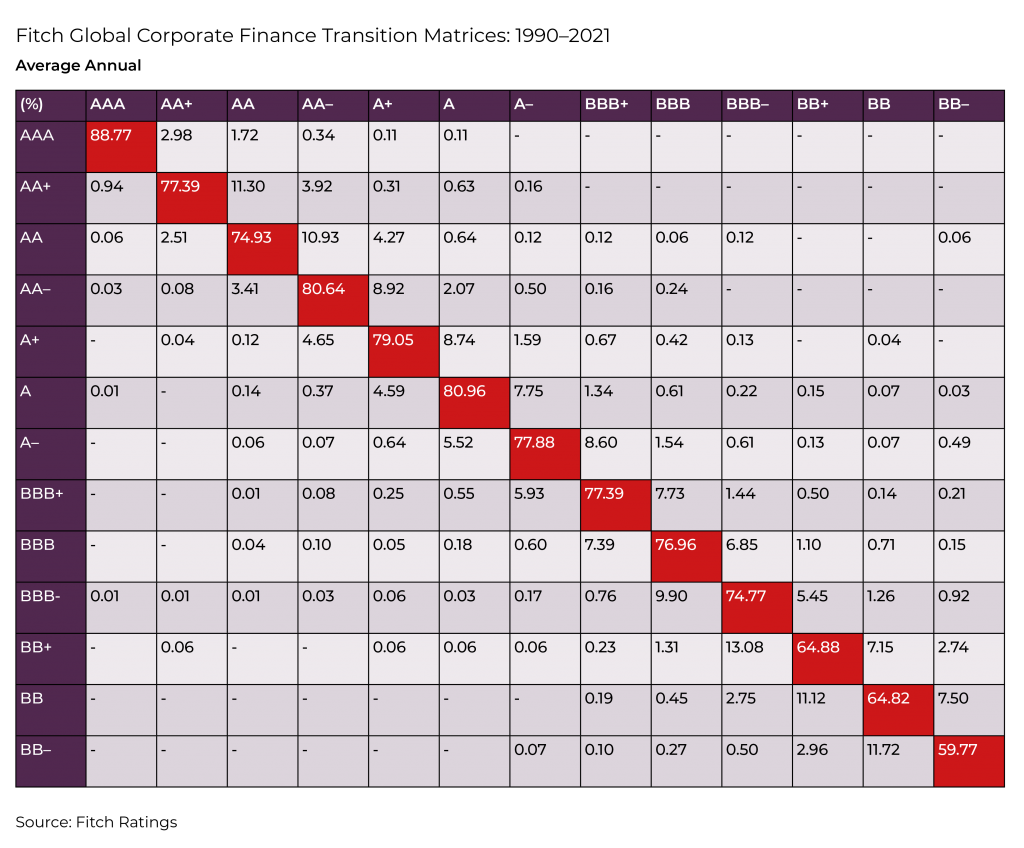

The table below shows the percentage of issuers in each ratings band that remained at that rating (or migrated to a different rating) averaged annually between 1990 and 2021.

“The table shows that as we move down the credit-rating spectrum, typically the probability of credit migration increases and with this, so too the probability of increased volatility. This should be managed by having small exposures to lower-quality credit and to individual lower-quality issuers,” explains Dickinson.

USBFs do typically limit exposure to BBB securities, and it is true that USBFs seeking a fund rating will naturally have the level of exposure to lower-quality credit capped. This should not stop treasurers from asking questions about overall exposure to lower-quality credits and limits to individual issuers.

“Aside from limits on overall exposure to BBB rated credit and limits on individual BBB rated issuers, HSBC Asset Management further manages risk by not buying the lowest-quality BBB- investment-grade credits from the outset,” says Dickinson. “This means if a BBB credit is downgraded by one notch, it still meets our investment-grade credit requirement, giving more time to carefully consider whether to hold, or perhaps sell the downgraded security.”

Relative value and risk

There are currently nearly 700 investment-grade corporate issuers with debt outstanding in USD with maturities of zero to three years. This represents a significant opportunity set for USBF managers with USD funds, but also needs significant credit research resource to analyse. Credit rating agencies provide a valuable service, but these official ratings form just a part of the process that an investment manager should follow when making credit-investment decisions for USBFs. Internal research and views on relative value and risk between sectors and issuers within sectors is key, which ultimately leads to decisions about investments and exposures.

Relative value and risk are important for USBFs, as they often employ a ‘buy and hold’ strategy regarding credit. This is largely because an USBF invests in a series of short-maturity assets, which means that an investment manager has a stream of constant maturities that can then be reinvested. However, the frequently prohibitive cost of selling very short securities may outweigh the return the new investment might generate. Although the short average tenor of instruments means the focus of an investment strategy can be changed more easily during periods of stress and uncertainty, it is important to get the initial investments correct, backed by solid credit research and due diligence.

Relative risk also needs to be considered and may lead to exposure limits to particular sectors or even issuers that may have the potential to be adversely impacted by current market conditions or events.

“When considering relative risk, we are not just looking at default and migration risk,” explains Dickinson. “We are looking more deeply at sectors or issuers that might be more volatile under particular market conditions. A frequently cited example is McDonald’s and a company such as ExxonMobil. One is a consumer non-cyclical rated BBB+, while the other is an energy company rated AA-. Yet the exposures to both may be similar or possibly even lower for ExxonMobil, due to increased volatility of returns in the energy sector.”

Credit is a key driver of yield improvement for USBFs, but it is vital that the credit exposure is managed appropriately to meet the key objectives of any USBF. Many of these funds will themselves have ratings, but these are very different from, and should not be confused with, the ratings assigned to debt issuers. Furthermore, two funds with the same rating could have significantly different holdings and exposure limits. Hence, confirming the importance to look closely at the risk characteristics of any fund, a crucial point made by Jonathan Curry, HSBC’s global chief investment officer for liquidity, in his article titled Time to get Proactive, to carefully “look under the bonnet” when selecting any fund.

Considerations for treasurers when looking at credit within an USBF

- Do not rely solely on the fund rating, as this is based on more than just the credit rating of the underlying securities.

- BBB securities are suitable investments for USBFs, but it is important to understand how exposure to this credit rating band is managed.

- Exposure management can include limits to BBB securities, limits to particular sectors or issuers, or only purchasing debt from issuers with a minimum BBB+ or BBB credit rating.

- The default risk for BBB issuers is not significantly high versus other investment-grade ratings bands.

- Migration risk is often overlooked and is key when managing volatility.

- Relative value across sectors is important when seeking to improve return, but it is not always true that high credit quality will reduce volatility.

Andrew Dickinson

Liquidity investment specialist | HSBC Asset Management Ltd

Andrew Dickinson is a liquidity investment specialist for HSBC Asset Management, where he has responsibility for engineering and delivering various strategically important product-development and growth initiatives. Andrew joined HSBC in 2018 and has worked in the asset management industry for more than 25 years. During this period, Andrew has worked as a portfolio manager, managing both fixed-income and money-market portfolios in various currencies; he has also been responsible for the leadership of the money-market businesses at both Credit Suisse and Aberdeen Asset Management.

Andrew holds a BA (Hons) degree in Economics and Computer Science from the University of the West of England.