Key practicalities

- Optimise access to more granular information on cash flows and cash positions;

- Driving efficiency by means of straight-through processing of short-term investments helps treasury departments become more efficient, while increasing transparency and reducing errors;

- Access to global cash investments through a single online trading interface; and

- Increased visibility and data accuracy, and potential reduction in uninvested cash.

Treasurers can use the expanding range of technology solutions to:

- View information from different sources;

- Consolidate the data to a single position shown on a single platform;

- Improve data consistency, integrity and reliability in terms of the cash position and liquidity forecast as a consequence of the harmonised infrastructure and business processes;

- Improve internal controls that are consistent across the organisation and compliant with local/external regulations; and

- Increase efficiency and transparency along the entire financial supply chain.

Coping with change

COVID-19 has highlighted the value of corporate treasury in efficiently managing cash liquidity and risk, and providing timely answers to complex questions from the board:

- Is there sufficient liquidity for this week?

- How can we survive supply chain disruption?

- Can we rely on our cash-flow and liquidity forecasts?

- How can we better manage FX risk and execution?

- Can banks and tech providers do more to assist?

Key drivers for technology developments

Open Banking initiatives and the creation of new regulators (such as the UK’s Payment Systems Regulator) has enabled the opening up of core high-value payment infrastructures, such as TARGET 2 for euros and CHAPS for sterling, as well as introducing new payment rails and solutions (for example, Pix in Brazil). In turn, this development has encouraged new and existing technology vendors to innovate as they compete with each other for new and existing customers and applications.

The innovation that the new regulations are delivering can transform working capital and liquidity management through new cost-effective ways of delivering a 360-degree view of the company’s financial position in real time. Treasurers can carry or pause payments at the touch of a button. Connections to multiple banking relationships allows for streamlining and invoice optimisation, centralising all transactions with options to paying them at the most effective time to optimise cash management.

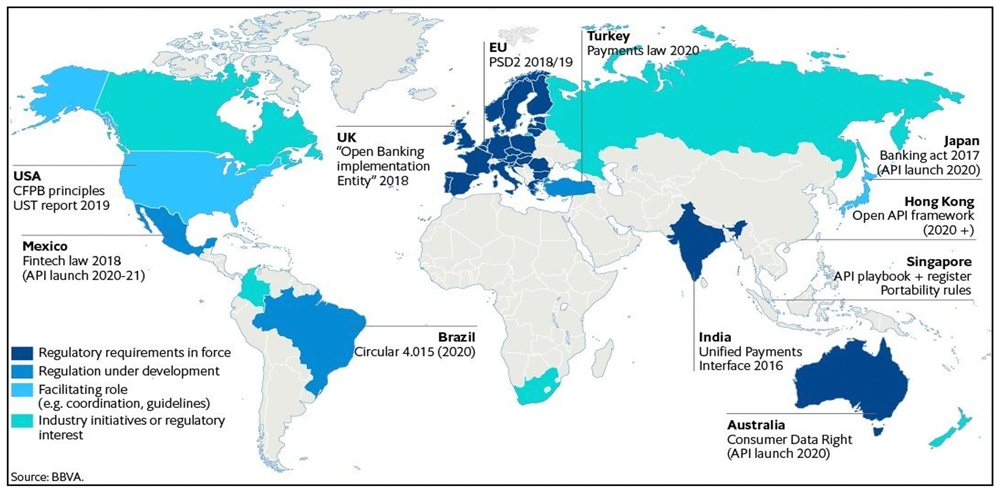

As for investment management, open banking promises easier digital onboarding, where application programming interfaces (API) can facilitate information processing, easing what is currently a complex process. This innovation is global in nature as the diagram below shows and continues to evolve as new countries get added to the map.

Real time

Payments that previously could only be processed during specific working hours and days are increasingly capable of being processed in real time and on a 24/7 basis. Treasurers will therefore have increased flexibility to schedule payments, but it will also make the work of the treasurer more complex, as payments could potentially be received at any time of day or night.

Whether through regulation or the entrance of new market participants, there is a growing list of innovative solutions and infrastructures that touch most countries in the world. This includes:

- Confirmation of Payee in the UK and the eurozone;

- Request to Pay;

- Lynx in Canada;

- FedNow in the US;

- Unified Payments Interface in India;

- European Payments Initiative in the eurozone; and

- New Payments Architecture in the UK.

There are also global initiatives such as the deployment of a new payments standard – ISO 20022, which organisations including commercial, central banks and SWIFT are in the process of deploying. For SWIFT, this will result in the replacement of traditional messaging types, such as MT940 and MT942, with new types that will have the potential to carry much richer data that is more standardised than before.

These developments will allow the treasurer to get a better view of cash balances on a real-time basis. At critical times of the reporting cycle (such as at year end), the ability to view and take appropriate action can have a major impact on reported financial results and important covenants.

The tools to aggregate balances from a range of banks across a number of different countries is not new. However, the costs of collecting the data and the investments in systems to enable the balances to be aggregated can sometimes be disproportionate to the value provided and the action that a treasurer could take.

The growing use of APIs and the increasing number of fintechs entering the market offers the treasurer a wide range of tools and resources for viewing these different balances and aggregating them (either by currency or by entity).

New data-visualisation software such as Tableau, PowerBi and QlikView provide treasury teams with powerful tools to customise cash visibility dashboards. In combination with APIs, treasurers are able to configure what is reported on, how frequently the data is updated (including in real time) and how the information is presented. Rather than providing static reports, senior management can be given access to their own dashboards, which they can customise and refresh at their own choosing.

Once the treasurer has access to the data, there are a growing number of software solutions and platforms that aggregate information either about different investment products or provide information about one investment product offered by a range of providers (such as money market funds – MMFs). These platforms allow the treasurer to apply any board-delegated permissions (for example, over level of credit risk, maximum size of exposure to a single institution, maximum tenor/duration) to a range of instruments or providers and to seek out the one that optimises the liquidity. One of the benefits of these platforms is that they can be linked to other systems to enable straight-through processing, removing the need to rekey data or requiring any manual intervention. This can reduce operational risks, freeing up time for the team and accelerating the end-to-end process.

Investment portals

The single-point-of-access portals provide substantial benefit to the investor, reducing the time spent searching for and accessing information. Furthermore, reducing the level of manual intervention in the deal process comes with a lower risk of fraud and error.

When using a portal to make investments, key stages of the decision-making and execution process will be automated but, importantly, rules about counterparty risk management can be adhered to.

Benefits of using portals

Straight-through processing

Straight-through processing (STP) enables the treasurer to link their dealing system with other related systems, including those involved with:- Dealing confirmations;

- Processing payments;

- Updating daily cash positions; and

- Accounting for the transaction.

- Reduce the risk of deliberate (or accidental) error by limiting the need for manual intervention;

- Increase the speed of transaction processing;

- Improve departmental operational efficiencies by reducing the time taken on daily investment activities;

- Improve the audit trail by ensuring that all activities can be monitored, and can support preventative and detective controls;

- Ensure that all activities are in line with the risk appetite established by the board in relation to approved counterparties, instruments and maturities; and

- Ensure that all activities are in line with delegated authorities established by the board.

Providers

Portals can either be provided by a financial institution to cover their products or by a third party, providing access to a wide range of different financial institutions. Most platforms are free to use, with typically minimal implementation costs.Choosing the right platform will depend on the complexity of the business and the level of business being transacted. For a business with relatively simple investment needs, a single bank platform with auto credit and debit facilities may cover the required visibility, control and yields that the treasurer needs. Where diversification into different products and funds is felt necessary (or required as part of the investment policy), a platform offering different institutions may be more appropriate.

Considerations for choice of platform

Fund selection

One of the most important considerations in choosing a portal is the type, range of investment solutions available and the information available on each product. The larger the selection of funds available, the more choice the treasurer has in identifying a suitable investment. Typically, independent portals have the advantage as they have no allegiance to any particular fund or investment provider.

Consolidated reporting

One of the primary drivers of money market portals is the need for consolidated reporting. Most portals offer consolidated reporting, providing one statement with all transactions, regardless of the amount of funds used. This report dramatically reduces reconciliation time and allows internal/external audit immediate access to all transaction history in one simple location.Consolidated application process

By using a portal that has a clearing agent or custodial relationship, an investor has to complete just the one application form, regardless of the number of funds utilised. If new funds are added to the portal, no further documentation is required by the client to add that new fund. Functionality such as this drastically reduces documentation and management time that is normally required to add or change funds.

- Is it independent?

- Does it offer ‘look-through’ capabilities to allow you to see what the underlying assets being invested in are?

- Does it offer consolidated reporting?

- Does it have one application form?

- Does it offer straight-through processing?

- Does it offer full disclosure of assets?