Uncertainty is a fundamental aspect of the economic landscape, and it is as high as it has ever been. This article aims to provide an overview of the current state of uncertainty in markets, the economy and treasurer decision-making. We will assess its impact on economic activity, and offer our views on portfolio positioning and expectations

The nature of uncertainty

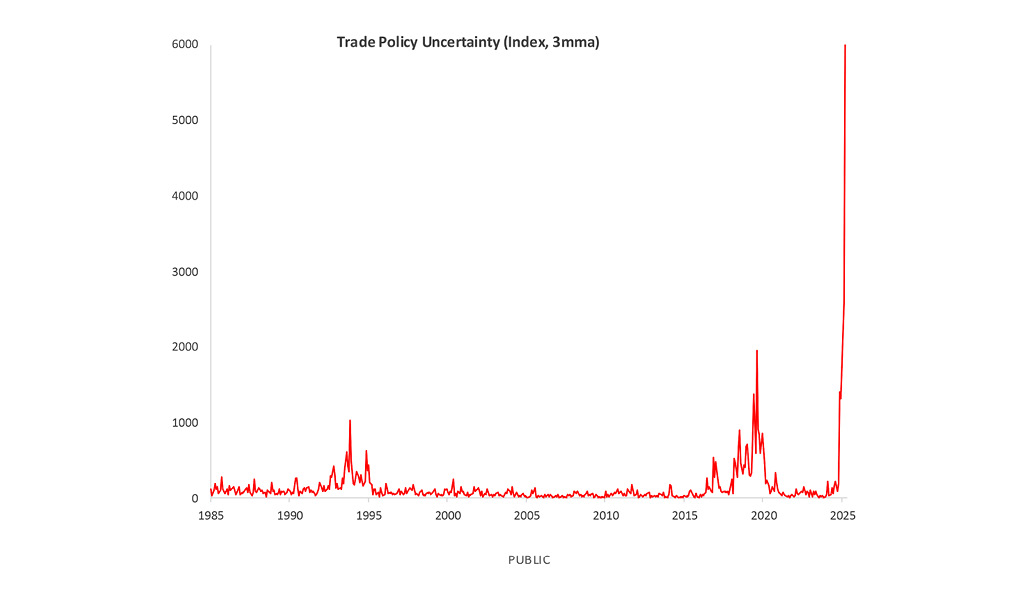

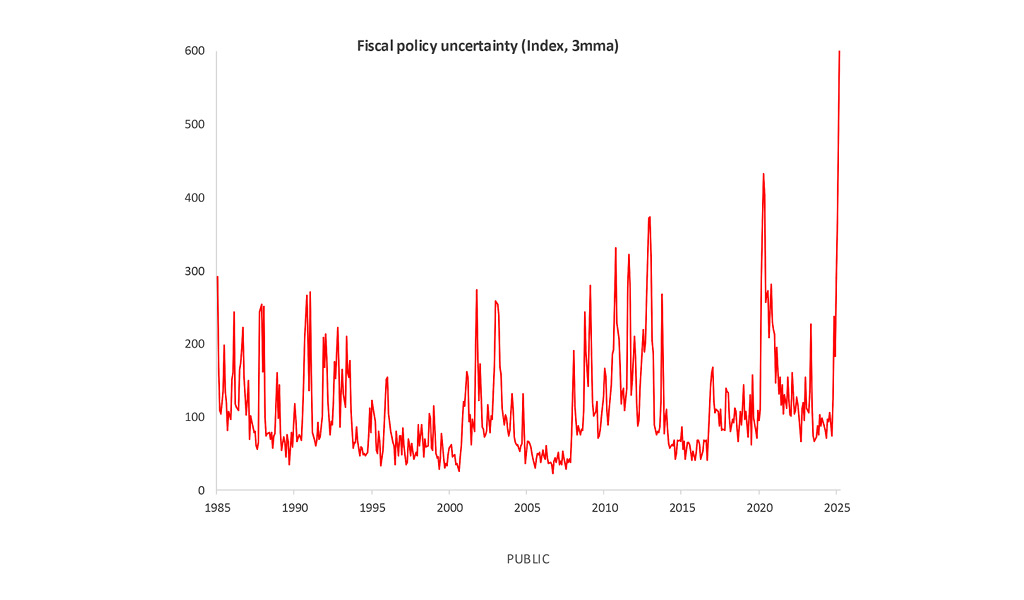

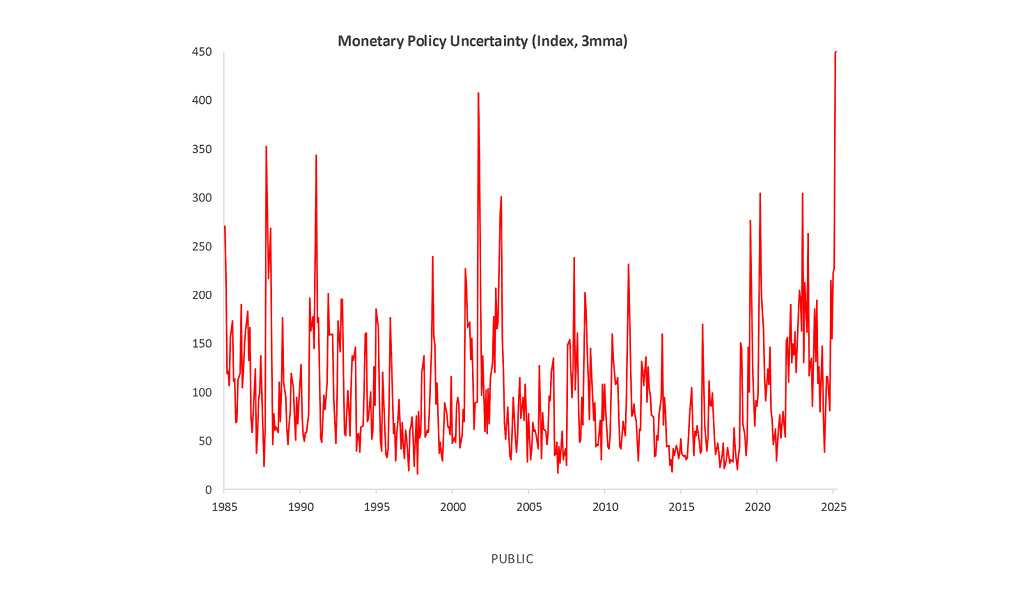

Uncertainty can be proxied through various surveys and quantitative measures to construct indices to compare previous episodes of political or economic tension (Fig.1 below). Looking back to the mid 1980s, we have witnessed numerous events that have contributed to heightened geopolitical and market uncertainty, including Black Monday, two Gulf wars, a Russian default, the collapse of Long-Term Capital Management, the dotcom bubble, 9/11, the Asian financial crisis, the global financial crisis, the Eurozone sovereign crisis, and the global COVID-19 pandemic. Yet today, as the charts below demonstrate, uncertainty is, in the words of chair of the European Central Bank, exceptional.

Measures of policy uncertainty have spiked, which typically means: higher stock market volatility; wider credit spreads; and higher equity premium.

Source: Macrobond, Bloomberg, HSBC Asset Management, May 2025. The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Asset Management. Consequently, HSBC Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. The views expressed above were held at the time of preparation and are subject to change without notice.

Despite the varied nature of the events noted above, the common thread is that uncertainty affects every economic actor, from individual investors to corporate decision-makers. The very existence of uncertainty leads to mechanically lower growth as decisions are deferred, and bets are hedged.

Impact on economic activity

The impact of uncertainty on economic activity is profound. When faced with uncertainty, individuals and companies tend to postpone, delay, or hedge their decisions. This behaviour dampens economic activity and leads to slower growth. For example, higher macro uncertainty weighs on growth characterised by increased unemployment rates, lower job openings, and increased precautionary saving. Discretionary spending, particularly on large-ticket items and luxuries, is typically the first to be cut.

Uncertainty also affects investment decisions. Companies may delay or cancel investment projects due to the unpredictable economic future. This can lead to lower productivity growth and reduced innovation. Additionally, uncertainty can impact consumer confidence, leading to lower spending and higher savings rates. This behaviour further dampens economic activity and can lead to a slowdown in economic growth.

Moreover, the impact of uncertainty is not uniform across sectors. Some industries, such as technology and healthcare, may be more resilient to uncertainty due to their innovative nature and essential services. In contrast, sectors like manufacturing and retail, where capital expenditures are planned years in advance may be more vulnerable to changing economic winds.

This, of course, affects the treasury department of corporations on every level. Cash requirements become increasingly uncertain and forecasting exponentially more complicated. And that’s without trying to optimise with the backdrop of central banks facing the exact same uncertainties, but in aggregate.

Our view

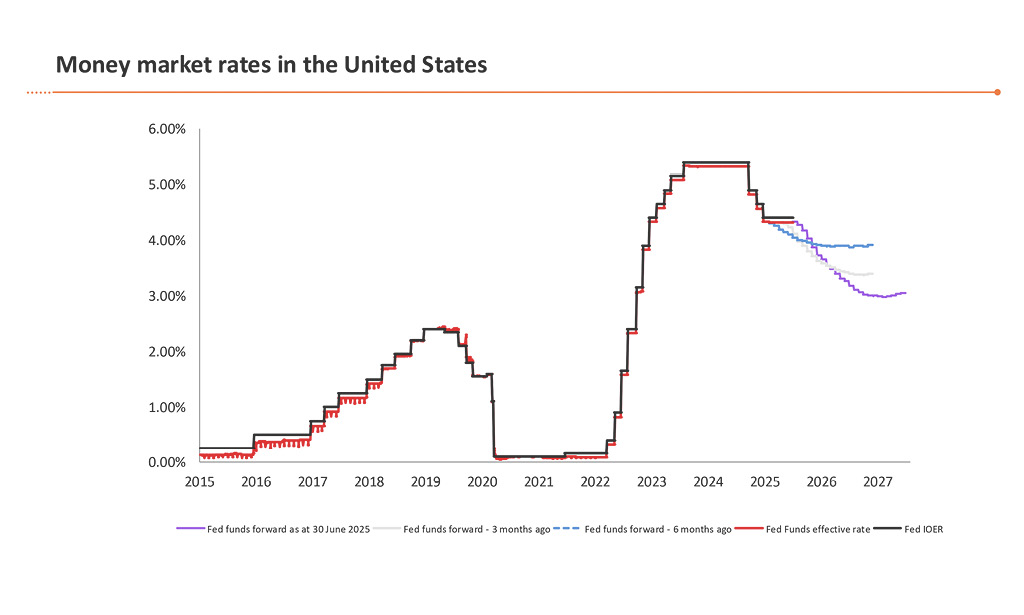

Given the current state of uncertainty, our view is that it is essential to adopt a cautious approach to portfolio positioning. Central banks’ decisions, or lack thereof, shape short-term investment strategies. Money market fund managers typically set their medium-term expectations on a six to 12 months pathway, and gradually tweak strategies based on tactical adjustments.

Our baseline macro scenario is for tariffs to settle close to current levels, leading to below-trend growth and above-target inflation in the US, while other major economies experience more trend-like growth and limited inflation pressures. Policy uncertainty remains high, and the data flow is likely to remain bumpy. Risk asset valuations are stretched in many areas, meaning that any deterioration in corporate fundamentals could add to market volatility.

In Europe, Germany’s fiscal revolution is a significant development that should lead to a fiscal boost for the Eurozone. The new rules allow states to run deficits, and increased defence spending and infrastructure investment are expected to provide a much-needed fiscal boost. However, the deployment of investment-led fiscal expansion can take time, and the real picture may be less than the headlines suggest.

In the UK, the possibility of stagflation, characterised by high inflation and low growth, is a distinct concern. The UK economy has been defying pessimistic forecasts, but without government-produced GDP expenditure, growth has barely budged since COVID-19. The Beveridge curve, which tracks the relationship between employment and job openings, suggests that the UK is close to a transition point, moving from low unemployment and high vacancies to high unemployment and low vacancies. Structural dynamics such as skills mismatches, reduced labour mobility, and low productivity can exacerbate this situation, leading to higher unemployment, lower vacancies, and relatively high wages.

Strategy

Considering the current level of elevated uncertainty, our strategies currently place even greater emphasis on diversification (of credit risk but also interest rate positioning) and risk management. We believe that a well-diversified portfolio can not only reduce credit risk and increase portfolio liquidity characteristics but also help mitigate the impact of uncertainty on investment returns. By spreading investments across different maturities, instrument type (fixed or floating), and issuers, exposure to any one of a range of outcomes is reduced.

Regular review and adjustment of allocations based on changing market conditions and economic outlooks is vital. As is constant vigilance for the sort of idiosyncratic issuer credit that can reveal itself in volatile markets. The same volatility in central bank expectations can produce tactical opportunities to extend duration where our strategic views differ from the market.

Sources: Bloomberg, HSBC Asset Management – FED funds forward rates are based on Fed Fund futures. The above figures relate to the past and past performance should not be seen as an indication of future performance. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Expectations

Looking ahead, we expect uncertainty to remain a significant factor in the economic landscape. Our long-held strategic view is that rates will ultimately be reduced by more than the market currently expects. i.e. slower growth will lead to renewed disinflation and, ultimately more central bank easing. Regarding specific markets this is certainly most true in the US, while the UK seems to be facing the greater risk of stagflation (high inflation, low or negative growth) creating significant challenges for monetary policy. The EU is probably closest to a neutral level of interest rates. The anticipated fiscal impulse and entrenched disinflation contrast favourably with the US and UK. Ongoing geopolitical tensions, trade disputes, and policy changes will continue to create an unpredictable environment for investors. In Asia, where certain money markets are pegged to the US dollar (China, Hong Kong) and those that are not have exposure to global trade flows and/or a basket of currencies (Australian and Singapore dollars), effects can be amplified to an even greater extent, leading to significant interest rate volatility. Our local currency money market strategies are valued by investors for combing local technical know-how with a consistent global investment process.

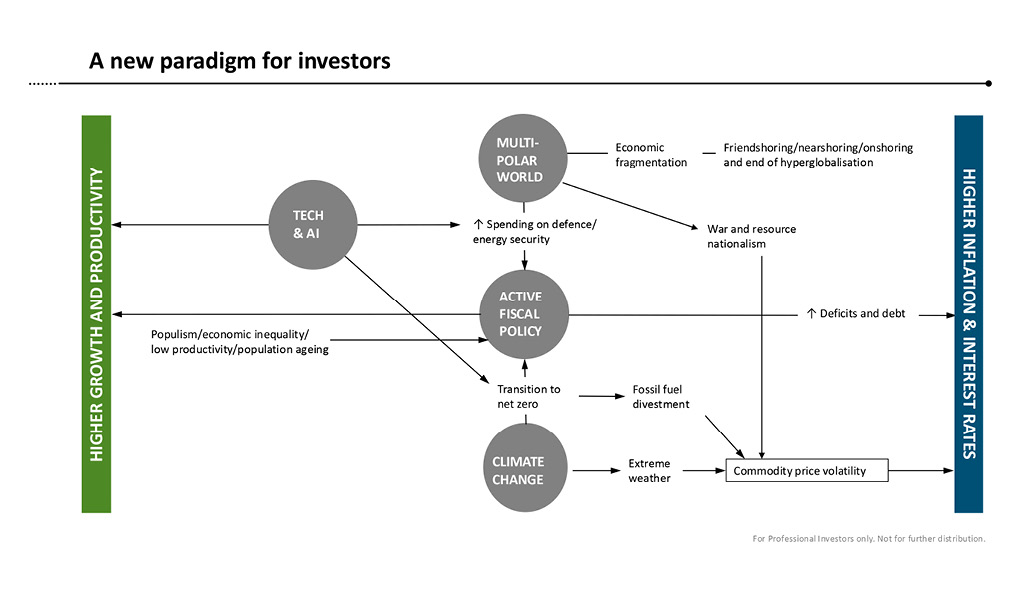

On a medium-term horizon, the shifting sands of technological innovation, active fiscal policy, economic fragmentation, and climate change create the potential of a new economic paradigm to replace that of a unipolar global economy anchored by US exceptionalism. This will create both threats and opportunities for economies around the world.

Source: HSBC Asset Management, April 2025. The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Asset Management. Consequently, HSBC Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document. For illustrative purposes only. The views expressed above were held at the time of preparation and are subject to change without notice.

Conclusion

In conclusion, uncertainty is an inherent part of the economic landscape, and its impact on economic activity is significant. Experience year to date in 2025 may be a foretaste of an extended period of structural uncertainty and, in the years to come, central banks may become less correlated than investors are used to.

Our view is that adopting a globally consistent, cautious, and diversified approach to liquidity strategy is essential to helping businesses to navigate this period of prolonged volatility. Regardless of how divergent country level economic and central bank policies become, our approach to managing the risks will be consistent. By understanding the nature of uncertainty and its effects, we can better position ourselves to manage our liquidity strategies and deliver on our core objectives. For treasurers, trying to manage risk and identify the opportunity, is becoming an increasingly complex activity. And trying to maintain a globally consistent set of principles across different jurisdictions with different rules only adds to compliance risks. It is therefore critical that treasurers lean into the expertise of their asset managers to ensure that the best tools and expertise are being applied to manage their liquidity.

A focus on risk management should always be the backbone of any liquidity strategy. Historically elevated levels of uncertainty underline this need more than ever.

Source: HSBC Asset Management, July 2025. The views expressed above were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way, HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target. This information shouldn’t be considered as a recommendation to invest in a particular sector or country shown.