Green and sustainable investing has evolved beyond all recognition and scale in the past 30 years. This is true for equity and fixed income investing as well as alternatives and non-public market asset classes. The liquidity landscape has changed considerably, too, with several investment options for treasurers that were not available as recently as five years ago. Nevertheless, it’s true to say that those investment options are somewhat more limited in short-term markets than might be thought ideal.

Whether by inclination or necessity, a growing number of corporate treasurers are seeking to ‘green’ their investment portfolios. In a previous paper (Implementing sustainable investment policy: a checklist for treasurers – Hub), we looked at the design of a sustainable treasury investment policy. In this article, we will look at the product opportunity set available to treasurers to implement such a strategy and highlight some of the unique challenges and opportunities that arise at the intersection of sustainable investment products and the idiosyncratic nature of money markets and liquidity management.

Cash – a notable omission from corporate carbon footprints

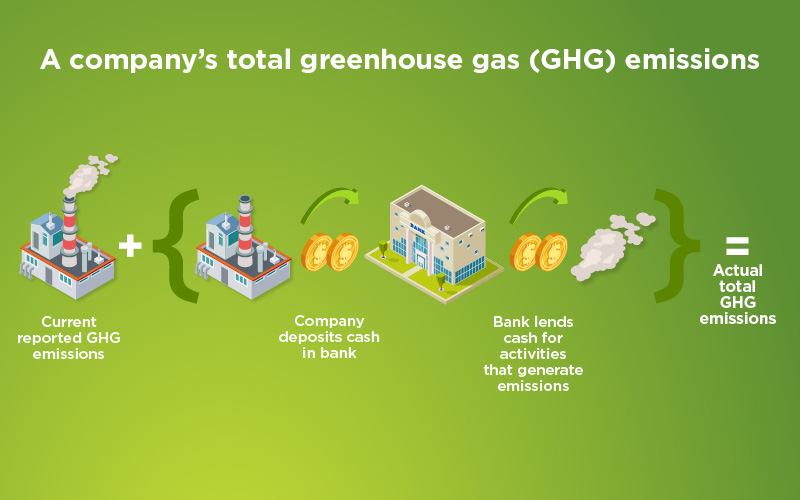

Treasury investment portfolios are often overlooked when companies set and monitor emission reduction targets. However, these portfolios can account for a significant proportion of the overall carbon footprint of a business via Scope 3 (or supply chain) emissions. Unfortunately, the overarching guidance on disclosures (Green House Gas Protocol, Taskforce for Climate Related Financial Disclosures) does not address this source of emissions on the basis of materiality.

Awareness is increasing and there are now several not-for-profit and academic papers that offer practical guidance to begin the process of reducing emissions from cash and treasury investment holdings.

The financial supply chain

At a fundamental level, these supply chain emissions, for a treasury investment portfolio, arise primarily from investments in banks and other financial institutions. Banking is a relatively low carbon intensity sector when considering Scope 1 and 2 emissions. However, the financial system has a pivotal role to play in the journey to net zero via lending activities, so called ‘financed emissions’.

Banks are the locus of short-term money markets, the problem with Scope 3 data

Banks played an outsized role in liquidity and cash investment markets, comprising most of the instruments in a typical money market fund or treasury investment portfolio. While best practice exists for Scope 3 disclosures for the banking sector (Partnership for Carbon Accounting Financials) implementation varies across institutions and geography and reporting is inconsistent.

Green investment products review

Unlike fixed income the development of dedicated ‘sustainable’ instruments (investments from the treasurers’ perspective) has been slow and intermittent. From the bank and finance sector there are some good reasons for this. Principally this is due to the short-term nature of the financing that banks receive via money markets and difficulties in identifying and segregating balance sheet assets to finance via short term funding. There are a growing number of non-bank issuers with active programmes including corporations, government/ agencies, and specialist lenders. However, the market remains small in terms of number of issuers and volume of issuance. In addition, most issuers are from the utility, energy, or industrial sectors. This is logical given these issuers have some of the largest roles to play in carbon reduction and thus significant transition capital expenditure. Unfortunately, such issuers tend to be rated below the typical A1/P1 requirement in most treasury investment policies.

Green or sustainability-linked investment product types:

Deposit: Typically, term deposit used to fund ESG assets as defined by the deposit takers green financing framework.

Reverse Repo: Collateralised loan in which collateral:

a. Proceeds finance sustainable projects (as with a sustainable deposit)

b. Is sustainable (green bond financing for example).

Commercial Paper: short-term investment that finances sustainable assets or where the issuer commits to meet sustainability linked performance targets.

Short-term bond: Green or sustainability linked bond that has a residual maturity of less than one year.

Treasury bill: Government debt whose proceeds are ring fenced for sustainable projects.

ESG MMF: A money market fund that gives consideration to the ESG scores of its investable universe in addition to its core objective of principal preservation and liquidity provision.

Broadly speaking the direct investment options described above (all except investment funds) come in two flavours,

1. Use of Proceeds investments: Funding to the issuer that is dedicated to a specific use or project. An example would be green commercial paper issued by a corporate, proceeds of which are used exclusively for sustainability projects. For a bank, the funding would be used to finance lending aimed at similarly sustainable capital expenditure.

2. Sustainability-linked investments: Issuance programmes that are labelled as sustainable and issued contingent on the company meeting sustainability linked targets (key performance indicators).

Green financing frameworks

Most instruments in the short-term sustainability space are issued under a corporation’s sustainability financing framework. In this way, companies seek to address the sustainability objectives of the liability side of a balance sheet in a holistic manner. It enables commercial paper, bonds and credit facilities to be addressed in a consistent manner.

Practical solutions – the art of the possible

The carbon footprint of treasury cash investments is considerable. Taking practical steps to proactively reduce exposures via sustainable investments is achievable but limited. A complementary approach would be to consider investing via traditional means within the construct of an ESG treasury policy (as suggested in our previous article). This could include traditional deposits, green investments and ESG labelled MMFs. Engagement goals should seek to further breadth and integrity of disclosures. What can be measured can be optimised.

Roadmap to future

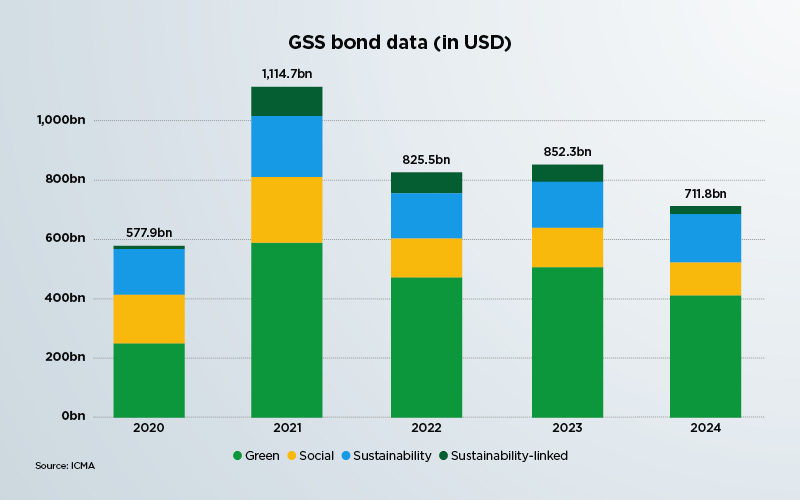

In 2014, ICMA published a governance framework for the issuance of green bonds, providing some much-needed standardisation for a nascent market. The equivalent document for commercial paper was published last month, October 2024. It provides a template for increased sustainably issuance in money markets.

Bank Scope 3 emissions data is (slowly) improving, and we can expect investment solutions to evolve to move climate focus from engagement to investment process.

While existing products may not cover all the funds available for investment – treasurers should actively consider the role that such investments can play alongside their existing investment strategies. By exploring and investing in what is currently available treasurers can begin a dialogue with a range of stakeholders including the board, staff, suppliers, and financial institutions. They, alongside other money market investors have a large engagement and advocacy role to play to promote both product growth and Scope 3 disclosures.

Corporations must also play a role by identifying suitable projects that can be funded via green or sustainable projects, be it commercial paper or credit facilities. For, without an increase in investable projects, the market for sustainable investment will remain relatively small.