Overview of the key factors that impact investment decision-making in India and highlighting the various investment instruments that are locally available.

Concise guide for corporate treasurers investing in India

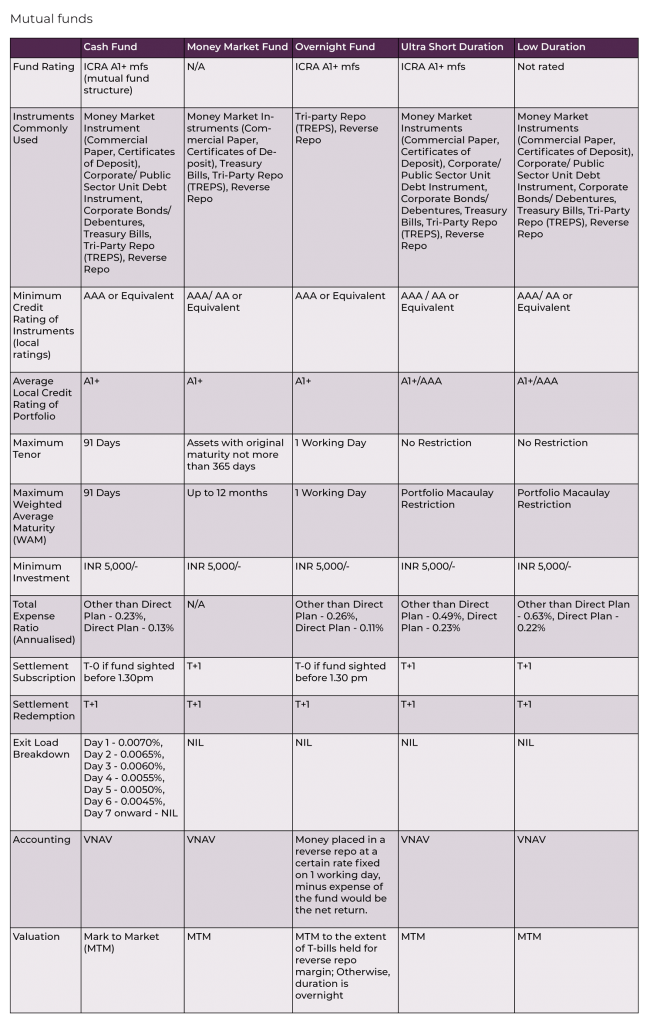

The liquidity fund industry in India has grown significantly since the first liquid mutual fund was launched in 1997. For corporate treasurers considering investing in the Indian market, it is important to be aware of some key differences between more widely used international money market funds (MMFs) and domestic Indian rupee funds. Ensuring that locally domiciled funds fit within the risk parameters of existing treasury policies and align to treasury objectives is key, in order that they efficiently support a corporate’s strategic objectives in India.

There are a range of different fund types in India that fall under the broad banner of ‘liquidity funds’. For international investors the naming conventions of these funds can be confusing when compared with those in Europe or the US. For example, in India there are cash funds, overnight funds and MMFs, each with different features and risk profiles.

In their investment manager selection process, it is incumbent on treasurers to identify those fund managers that can demonstrate an investment philosophy that is aligned with their own risk appetite. Alignment will be evident in the investment guidelines set by an investment manager to govern all aspects of the portfolio management, from asset types and issuer concentration to duration and liquidity requirements.

While investment guidelines should always follow the prevailing regulatory framework, some managers will go beyond the regulatory constraints and offer a more conservative fund than the regulation requires.

Fund manager differentiation criteria include:

While environmental, social and governance (ESG) funds make up just 1% of total MMF assets, sustainable investment solutions continue to grow broadly across all asset classes and now represent approximately one-third of all global assets under management. Investor appetite varies from region to region, and across Asia ESG interest remains low by comparison. Where it does occur, it is typically from US- or European-headquartered companies that have a top-down approach, imposed on local treasury centres in the region. Interest in sustainable investments is likely to grow – especially given the 2021 announcement that India would achieve net-zero emissions by 2070.

Global bond index inclusion

Just as China did two years ago, India is hoping to join the global bond indices in 2022. Inclusion is not just beneficial from a macroeconomic standpoint, but for Indian companies the potential uptake in foreign capital inflows into the government bond market will see overall costs of borrowing falling, helping local companies with their capital requirements. Foreign investors will be able to access a substantial, diversified pool of Indian corporate issuers that previously may have been overlooked or inaccessible.

CIO – liquidity, Asia-Pacific | HSBC Asset Management (Hong Kong) Ltd

Gordon Rodrigues is the Chief Investment Officer for the Liquidity Business in A-Pac. Prior to that he was the Head of Asian Rates, FX and Liquidity in the Asian Fixed Income team within HSBC Asset Management in Hong Kong. He has been working in the financial industry since 1992. Rodrigues joined HSBC Global Markets, India in 1994 as a Treasury Sales Specialist covering Corporate and Institutional Clients and traded Credit Products on the Fixed Income Trading Desk from 1998-2002. Gordon moved to HSBC Asset Management India in 2002 to set up the Fixed Income Investment Team and headed the team till 2007 before relocating to Hong Kong.

Prior to joining HSBC, Rodrigues worked as a Foreign Exchange & Fixed Income Dealer at Merwanjee Securities in Mumbai. Rodrigues holds a Master’s degree in Finance and a Bachelor’s degree in Electronics Engineering, both from the University of Mumbai (India).