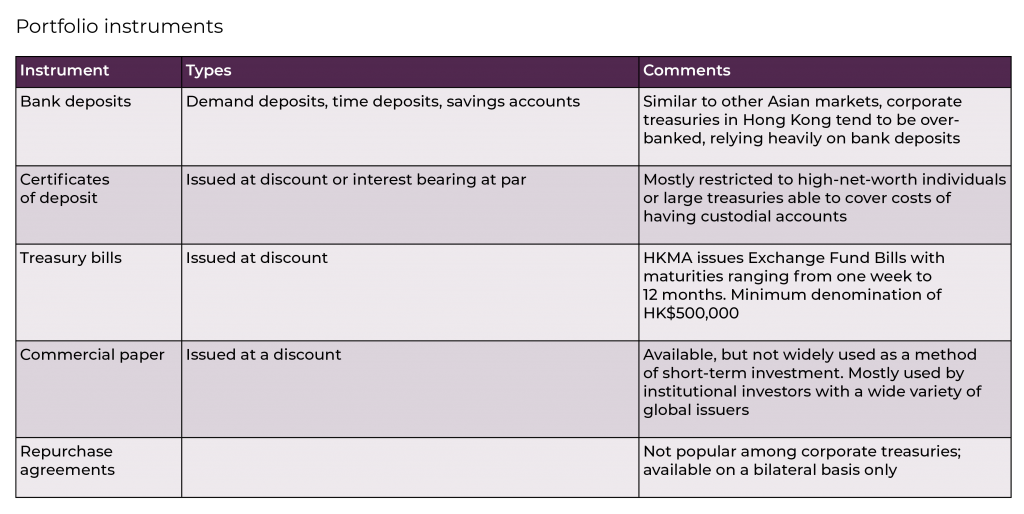

The key factors impacting investment decision-making for corporate treasurers in Hong Kong, along with the specific details of the various investment instruments available locally.

Concise guide for corporate treasurers investing in Hong Kong

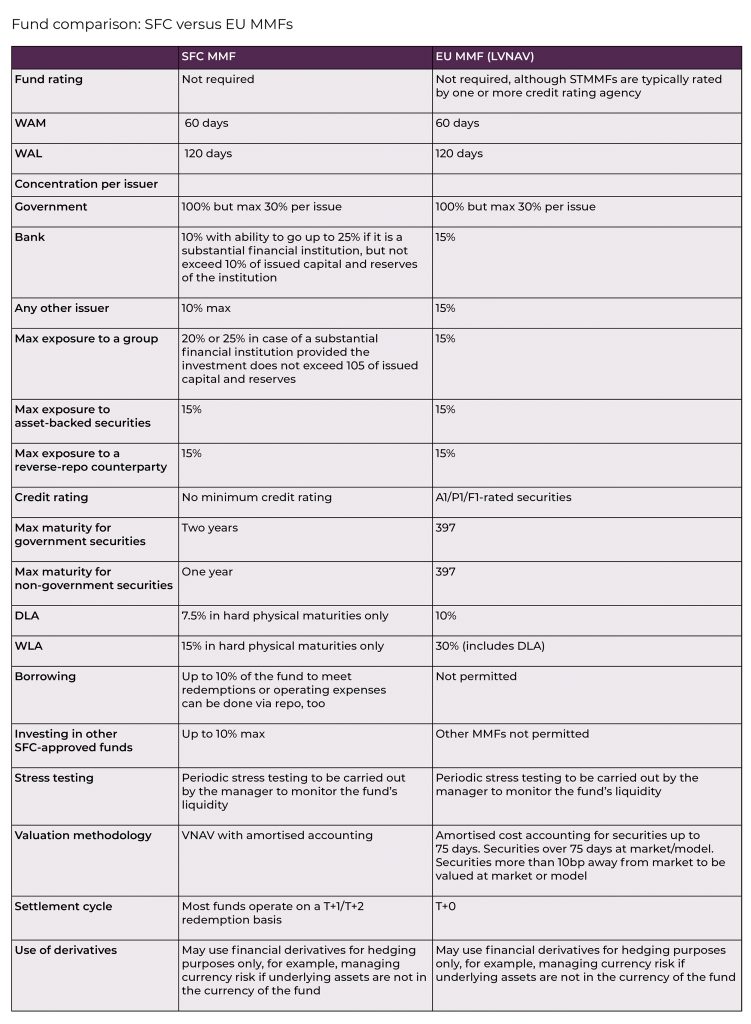

There are two types of MMFs catering to different markets with different regulators: MPFA funds, regulated by the MPFA, represent the larger of the two and focus on the pensions market; standard MMFs are used by corporates and financial institutions, and are regulated by the SFC. In recent years the SFC has made efforts to align its MMF regulations with global standards (such as those from IOSCO).

The current regulatory framework in Hong Kong remains relatively broad compared with other large financial markets, which results in significant variations on how funds operate compared with domestic and global alternatives.

Many of the businesses operating in Hong Kong are part of global enterprises that are supported by global treasury policies. The greater the degree to which a local MMF is aligned with global standards, the easier it is to use these funds from a governance and risk-acceptance perspective. In other words, when selecting the right fund manager and fund, the more aligned they are with global treasury policies and international norms, the quicker the internal approval-application process, and the lower the associated risks of monitoring different funds with different investment rules.

As SFC regulation of domestic MMFs has evolved, there are increasing similarities with the regulation governing international MMFs. However, as much as the table above highlights similarities between SFC and EU MMFs, it also shows significant variations, providing scope for domestic managers in Hong Kong to manage funds differently. Investors therefore need to be fully aware of the philosophy, objective and internal investment constraints and/or guidelines of a manager to ensure they fall within treasury policy. Particularly so with regards to the minimum credit ratings, external fund ratings, diversification, duration and liquidity requirements.

Also worthy to note is the fact that in certain regards, the constraints set by the credit rating agencies and the internal investment guidelines of managers of international funds may be more conservative from a diversification and risk perspective than the regulation actually requires. Hence, in reality, a domestic fund in Hong Kong may be further distinguished in practice than the comparison between the regulatory frameworks may imply.

In addition to the investment approach adopted, investors also need to understand:

While the market for ETF MMFs remains nascent, demand for ETF MMFs in Hong Kong is expected to rise as demand for passive funds continues to grow across all asset classes.

Institutional/rated MMFs

Most of the MMFs in the Hong Kong market are T+1 or T+2 on redemption and unrated. Globally, institutional MMFs are normally rated and T-0 funds, with subscription/same-day redemption, and this market is expected to expand over the next few years.

“Our HSBC Global Money Fund is the only HKD money market fund, domiciled in Hong Kong to be rated AAA (Fitch Ratings) and is T0,” explains Gordon Rodrigues, CIO – liquidity, Asia-Pacific, HSBC Asset Management (Hong Kong) Ltd.

As the Hong Kong banking deposit system gets more disintermediated and interest rates rise, the attractiveness of MMFs (with daily same-day liquidity in the overnight to one-month range) is expected to see continued demand.

Environmental, social and governance (ESG)/sustainable investments

Investor appetite for ESG across Asia remains low compared to the US and Europe. ESG in Hong Kong is, however, gaining increasing interest on the fixed-income side. But for ESG MMFs, Hong Kong is still far behind the markets in Europe and America. That said, a number of fund managers are launching funds that invest in Asian issuers of sustainable bonds, green bonds, sustainability-linked bonds, transition bonds and social bonds.

Portals and platforms for ease of access and straight-through processing

The use of electronic/digital platforms is less prevalent in Hong Kong compared with other IFCs. However, adoption levels are increasing as the benefits of portals in dealing execution, providing robust audit trails, reducing the level of manual intervention and generally supporting a robust controls infrastructure become clearer and less expensive to implement and maintain.

CIO – liquidity, Asia-Pacific | HSBC Asset Management (Hong Kong) Ltd

Gordon Rodrigues is the Chief Investment Officer for the Liquidity Business in A-Pac. Prior to that he was the Head of Asian Rates, FX and Liquidity in the Asian Fixed Income team within HSBC Asset Management in Hong Kong. He has been working in the financial industry since 1992. Rodrigues joined HSBC Global Markets, India in 1994 as a Treasury Sales Specialist covering Corporate and Institutional Clients and traded Credit Products on the Fixed Income Trading Desk from 1998-2002. Gordon moved to HSBC Asset Management India in 2002 to set up the Fixed Income Investment Team and headed the team till 2007 before relocating to Hong Kong.

Prior to joining HSBC, Rodrigues worked as a Foreign Exchange & Fixed Income Dealer at Merwanjee Securities in Mumbai. Rodrigues holds a Master’s degree in Finance and a Bachelor’s degree in Electronics Engineering, both from the University of Mumbai (India).