Concise compendium of the key fundamentals impacting investment decision-making for corporate treasurers in Australia, along with the specifics of the various investment instruments.

Concise guide for corporate treasurers investing in Australia

Driven by a domestic investor base dominated by institutional investors and superannuation funds and the relatively minor role MMFs have in Australian short-term funding markets, regulators’ emphasis has remained on industry guidance rather than prescriptive MMF regulation seen in other markets such as the US or Europe.

Further distinguishing domestic Australian MMFs from international alternatives is the market convention for fund valuations, which is fully mark-to-market or variable net asset value (VNAV). Australian domestic funds are also less likely to carry an external credit rating, which is the standard for international funds.

However, while the Australian market for MMFs is relatively small – representing less than 1% of the market for managed funds – it nonetheless provides cash-investment solutions to investors seeking credit diversification while maintaining liquidity.

Investment in Australia’s managed funds market is dominated by institutional investors and superannuation funds. In 2021, the market was split between retail investors (13%), institutional investors (40%) and superannuation funds (47%). The high proportion of institutional and superannuation fund investors has influenced the evolution of the Australian domestic MMF segment of the industry as risk profiles, valuation methodologies and fund features required by these investor types may be different to those typically required by corporate treasury or retail investors.

Most MMFs use the VNAV methodology with funds being mark-to-market on a daily basis. By comparison, the norm for international prime MMFs is to use a methodology known as low volatility net asset value (LVNAV), in which securities out to 75 days can be valued using amortised cost accounting. As a result of using VNAV and running typically longer-duration portfolios, following recent aggressive tightening by the RBA, a number of Australian domestic funds are showing negative returns. However, as most investors are institutions or superannuation funds that invest over a medium-term horizon, short-term instances of negative rates are not considered critical.

With retail investors only a small part of the investment landscape in Australia, there is only a very small amount of regulation aimed specifically at MMFs – apart from a stipulation under the Corporations Act of 2001, that the name of the fund must not be misleading or deceptive. The regulators have clear rules for the standardisation of naming conventions of MMFs to distinguish between ‘money market funds’ and ‘enhanced’ money market funds, which may have very different risk profiles and to reduce the risk of mis-selling.

When ASIC looked at MMF regulation in the wake of the 2008 global financial crisis, it concluded that exposure to systemic risks such as fund redemption was low given the main characteristics of the market, including:

Australian domestic MMFs are highly concentrated around bank instruments with certificates of deposit (CDs) issued by the main four banks typically representing 65–80% of most funds, with only limited diversification into smaller banks. As a result, investors achieve only limited diversification of counterparty risk – especially as all funds would tend to have similar exposures to the same issuers. By comparison, international MMFs offer greater diversification through issuers in markets beyond Australia, including Japan, South Korea, New Zealand, Hong Kong, China, Europe and the US, and so offer greater issuer and geographical diversity.

While there is no requirement for Australian domestic MMFs to hold rated instruments, in practice they hold highly rated ones, with very limited exposure to assets that are slightly less liquid, such as term repurchase agreements, securitised debt or lower ST rated A-2 assets. The market is therefore narrow, but of a reasonable high quality.

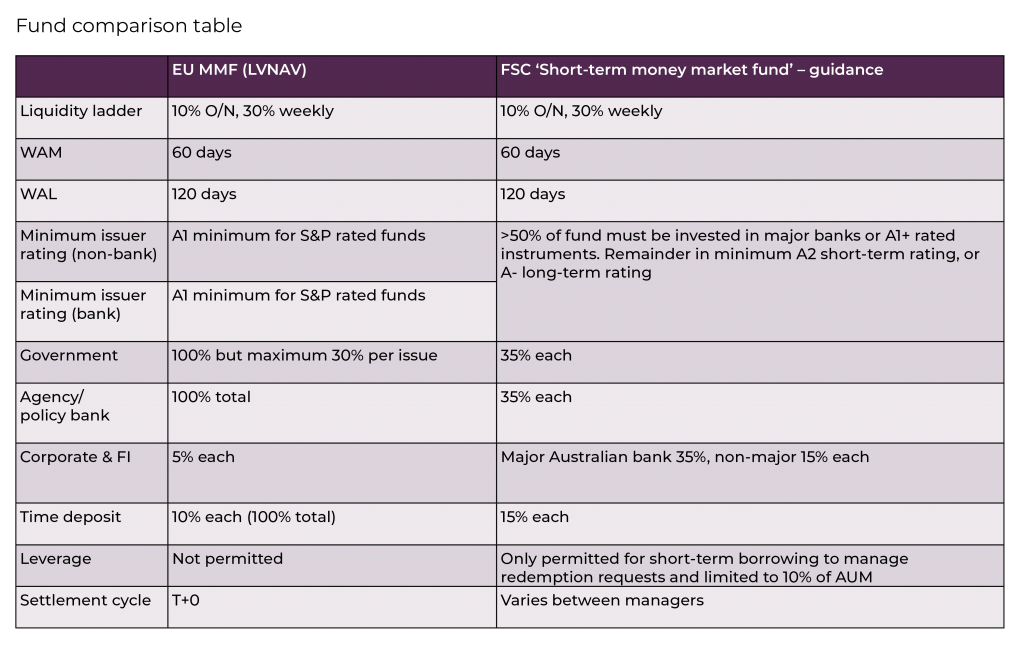

In 2017, Australia’s Financial Services Council (FSC) issued a guidance note setting out expectations in terms of investment objectives and vehicles.[ii] The FSC categorised MMFs as either short term or standard (otherwise known as enhanced cash funds) and expected funds:

MMFs must impose concentration limits and/or diversification ratios to reduce a fund’s exposure to a single entity, the FSC guidance states. However, exposure to money market instruments issued by major Australian banks should be capped at 70% of the MMF portfolio and exposure to non-major, non-government money market instruments to be capped at 15% of the portfolio. The regulators are mindful of international standards and apply liquidity limits that are similar to those in Europe (see below). Thus, guidance suggests that a 10% minimum should be invested in daily liquid assets and 30% in weekly liquid assets.

Overall, the landscape for Australian MMFs can be characterised as rigorous in terms of its guidance – fund managers can largely be expected to hold to ASIC and FSC guidance – but low in statutory regulation, in part due to the concentration around high-quality assets and instruments.

Credit ratings – In contrast to international MMFs, Australian onshore MMFs are typically unrated, although there are instances of both international and domestic investment managers obtaining ratings for Australian domestic MMFs.

In line with corporate treasury expectations, the market convention for international MMFs is that they are typically rated by one or more credit rating agencies.

Corporate treasurers typically operate within a range of well-defined risk parameters from counterparty risk tolerance to diversification constraints. Identifying a MMF that sits within these parameters requires careful consideration of the manager’s investment philosophy, the regulatory regime under which they operate, as well as constraints a manager must adhere to, to maintain a fund credit rating.

CIO – liquidity, Asia-Pacific | HSBC Asset Management (Hong Kong) Ltd

Gordon Rodrigues is the Chief Investment Officer for the Liquidity Business in A-Pac. Prior to that he was the Head of Asian Rates, FX and Liquidity in the Asian Fixed Income team within HSBC Asset Management in Hong Kong. He has been working in the financial industry since 1992. Rodrigues joined HSBC Global Markets, India, in 1994 as a Treasury Sales Specialist covering Corporate and Institutional Clients and traded Credit Products on the Fixed Income Trading Desk from 1998-2002. Gordon moved to HSBC Asset Management India in 2002 to set up the Fixed Income Investment Team and headed the team till 2007 before relocating to Hong Kong.

Prior to joining HSBC, Rodrigues worked as a Foreign Exchange & Fixed Income Dealer at Merwanjee Securities in Mumbai. Rodrigues holds a Master’s degree in Finance and a Bachelor’s degree in Electronics Engineering, both from the University of Mumbai (India).