Today, corporate treasurers and cash management professionals face unprecedented challenges in the wake of high-profile banking crises and easing regimes embarked upon by the Federal Reserve and other developed market central banks. The pressure to optimise liquidity, yield and principal protection remains high. Within that context it seems a timely opportunity to revisit the relative merits of two of the most useful tools in the treasurer’s toolkit.

Bank deposits (both term and call) are a valuable option for treasury investment strategies, particularly when considering that having a roster of multiple relationship banks allows for more competitive pricing power. That said, it is important to consider both benefits and potential risks of deposits when compared with money market funds (MMFs). MMFs present a compelling alternative to traditional bank term deposits, going further in addressing the two key objectives of treasury policy, namely capital preservation, and liquidity provision.

They are less operationally complex, more liquid, have a diversified approach to counterparty risk (a crucial factor we face in today’s uncertain financial environment) and can offer the potential for higher net returns. In this note, we consider the five key elements that will equip corporate treasurers with information and insights on the relative advantages of utilising MMFs and term bank deposits.

1. Counterparty risk

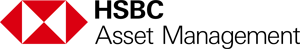

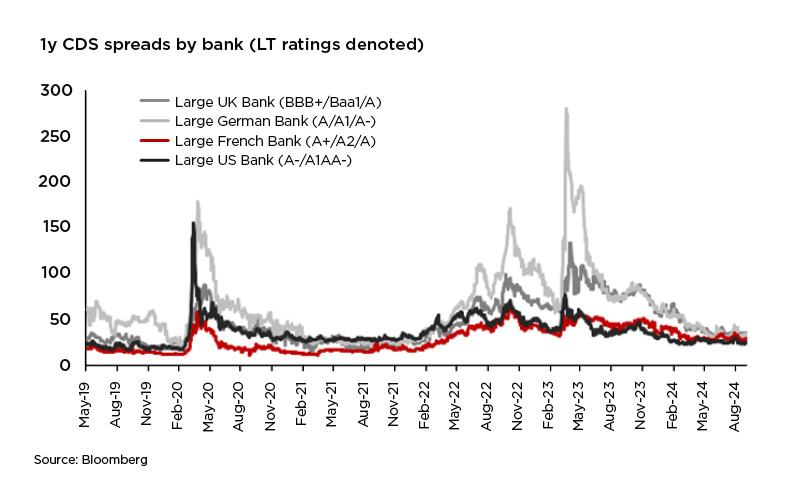

Despite nearly 18 months passing since the collapse of Silicon Valley Bank (SVB) and Credit Suisse’s acquisition by UBS, counterparty risk remains top of mind. Bank deposits expose investors directly to the financial health of a single bank in which funds are deposited. Should a bank face financial instability, the liquidity and safety of funds deposited at that institution can be in serious jeopardy, although this may be mitigated if asset liability netting agreements are in place. Additionally, efforts to enhance yield by terming out deposits further increases implicit counterparty risk – the longer you are exposed to a given counterparty, the more time there is for something to go wrong. High profile, and undoubtedly high consequence, bankruptcies and restructurings dominate headlines and institutional memory. In reality, a treasury team’s counterparty risk challenges are ever present. Credit rating migration (where a bank’s rating is downgraded below thresholds specified in treasury investment policy) can lead to intensive additional due diligence, increased resource requirements across the organisation and, ultimately, financial opportunity loss should a decision be made to attempt to break a deposit at an institution a treasury department no longer sees as safe.

Individual MMFs mitigate counterparty risk through portfolio diversification. MMFs invest in commercial paper, permitting broader diversification across issuers and potentially enhancing yield while adhering to stringent credit quality standards. Prime MMFs employ dedicated in-house credit research teams to continuously monitor and assess the creditworthiness of their holdings, which in turn adds an additional layer of oversight.

2. Liquidity

Liquidity is a crucial consideration for cash management decisions. Bank deposits present both benefits and drawbacks in this area. While bank deposits generally offer overnight liquidity, this can be subject to change in times of financial stress where access to funds may be delayed, potentially leaving cash managers in a vulnerable position. Additionally, term deposits (deposits that are held for a pre-specified period) often come with breakage fees that penalise depositors for making early withdrawals, even in normal market conditions.

MMFs, on the other hand, offer much more robust liquidity to cash investors. They offer same-day liquidity (T+0) with funds available shortly following a redemption request.

3. Ease of implementation

Bank deposits often require managing relationships with multiple banks to diversify large cash balances, which can complicate cash management operations. This diversification strategy is necessary to minimise exposure to any single bank, especially given the collapse of SVB, the fate of Credit Suisse and the concurrent regional bank crisis experienced during 2023. Counterparty risk due diligence adds another layer of complexity, requiring ongoing monitoring and assessments of each bank’s financial health. Additionally, not all treasury teams have access to a deposit placing platform resulting in the need to execute specific instructions across several banks, which can lead to increased operational workload and risk of errors.

MMFs, on the other hand, offer a more streamlined implementation. MMFs require only a single transaction to gain exposure to a diversified portfolio of investments, significantly reducing operational burden. This not only saves time and reduces operational risk but also simplifies the management of large cash balances that would have to be spread out across banks were they to be deposited. With MMFs, ongoing maintenance is minimal. The money fund managers handle investment decisions and diversification, which in turn frees up cash management professionals to focus on other important aspects of their firm’s broader financial strategy.

4. Fees

The fee structure for bank deposits can often be opaque and relationship dependent, varying widely based on the terms negotiated between bank and client. These fees may include service charges, account maintenance fees, breakage fees and other costs that are not always transparent. This can make it challenging to gauge the true costs and benefits of placing a deposit.

In contrast, MMFs offer a more straightforward fee structure, usually charging a single management fee embedded into the net yield of a fund. This allows cash managers to more clearly understand the costs associated with investing in a MMF versus a bank deposit. MMFs also do not charge separate fees for subscriptions or redemptions.* Lastly, since MMFs are professionally managed by large asset management companies, fees charged reflect the value of active management, credit due diligence and ongoing oversight.

5. Yield

The difference in pricing dynamics between bank deposits and MMFs is important to understand. Deposit yields are normally driven by an individual bank’s funding needs, which vary over time, from bank to bank, dependent on market dynamics, regulatory considerations, size of institution and across geography. Money funds operate in the same market but will typically have access to a larger range of counterparties (bank, agency and corporate) than a more limited list of banks approved for direct deposits. Therefore, a money fund will have more options when investing allied to economies of scale in pricing. Due to the active management aspect of a MMF, they can often be quicker to pass on rate hikes through their yield, and, conversely, preserve yields as rates are cut. In most market regimes, MMFs have tended to outperform bank deposits while offering the risk, diversification and operational benefits described above.

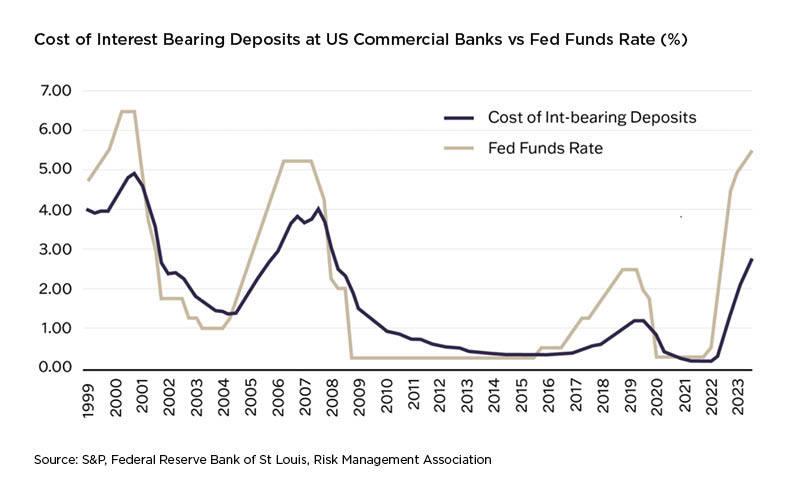

The relationship between changes in deposit rates and changes in market-based short-term interest rates is commonly referred to as “deposit beta” and illustrated above. You can see that in aggregate, deposit rates have lagged the Fed funds rate during tightening cycles. Furthermore, during past easing regimes, many times deposit rates haven’t caught up with the Fed funds rate by the time the Fed begins to cut.

Conclusion

Treasury investment returns are a complex concept. The commonly held refrain of ‘return of capital, not return on capital’ is to the fore but the relative yield between investment options is an important consideration alongside the primary core objectives of capital preservation and liquidity provision.

The risk-return trade-off is assessed individually but caution is warranted when considering changing preferences based on the interest rate cycle. While it may be tempting to extend portfolio duration or assume additional credit risk via term deposits at a time when interest rates are declining, the primary considerations of counterparty risk and liquidity always apply. Interest rates are typically cut in response to a deteriorating economic environment, exactly the situation where increased credit due diligence is appropriate. Core benefits of a MMF apply across business and interest rate cycles.

* Some types of money market funds may implement redemption fees during rare circumstances as per local regulations

This article was updated on 9 January, 2025