The financial landscape is undergoing a significant transformation with the emergence of digital assets, particularly stablecoins and tokenised assets. These innovations present both opportunities and challenges for traditional finance practitioners including corporate treasurers. This paper aims to provide a comprehensive overview of stablecoins and tokenised money market funds, highlighting their potential impact on the financial ecosystem, and comment on current developments in certain markets

Cryptocurrency

Before we discuss stablecoins, we need to understand cryptocurrencies. A cryptocurrency is a digital currency that doesn’t require a central bank or financial institution to verify transactions. Instead, this virtual currency is verified and recorded with blockchain technology, creating an unchangeable ledger (database) that tracks the purchase and sale of digital assets.

Some cryptocurrencies are speculative in nature, while others, known as stablecoins, seek to maintain a stable value and act as a digital version of cash.

Cryptocurrencies in general are moving closer to the mainstream, with a combination of increasing adoption by both retail and institutional investors as well as increased regulatory certainty. Part of the regulatory clarity has been a shift in restrictions global banking regulators had previously placed on banks exploring crypto-related product offerings. For example, in the United States, regulators announced in March 2025 that banks no longer require advance permission to engage in crypto-related activities, so long as the associated risks are managed. Given the global nature of stablecoins, regulators across the world are having to develop their own framework, at pace, to maintain some form of local guidelines for how these issuers and their transactions are governed. This has opened the door for traditional finance players to engage more fully in the digital asset landscape.

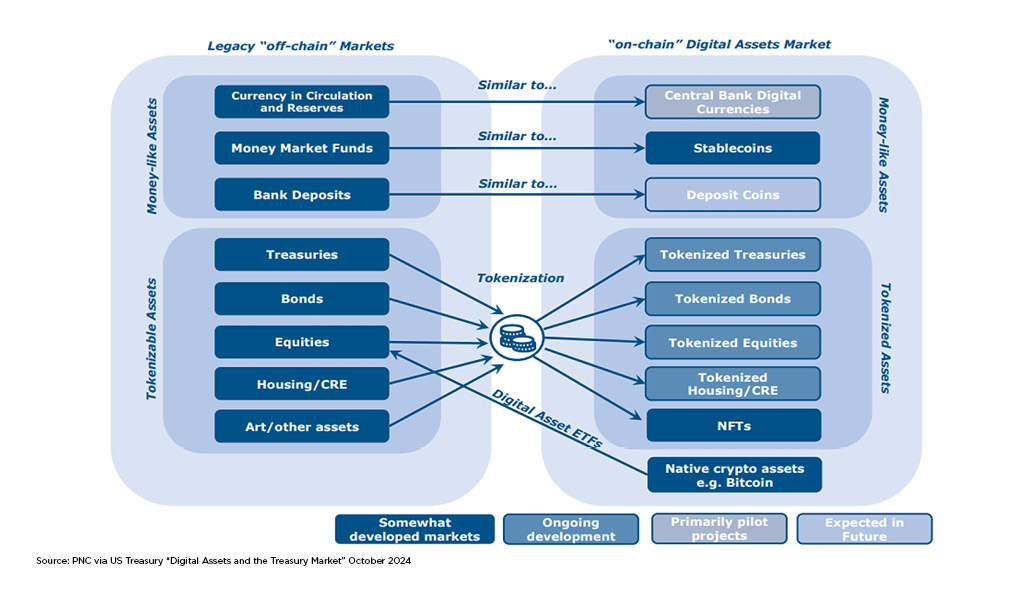

It is worth noting that while parts of the cryptocurrency industry appear completely foreign to a traditional asset manager, there are products that appear similar, and derive their value from or mimic traditional asset management products.

Stablecoins

A stablecoin can be viewed as a bridge between traditional finance and digital assets. They are used for trading on crypto exchanges as well as for payments and remittances. They exist on a blockchain, but their value is typically pegged to another asset, most commonly the US dollar, so stablecoins don’t experience the level of volatility of other cryptocurrencies.

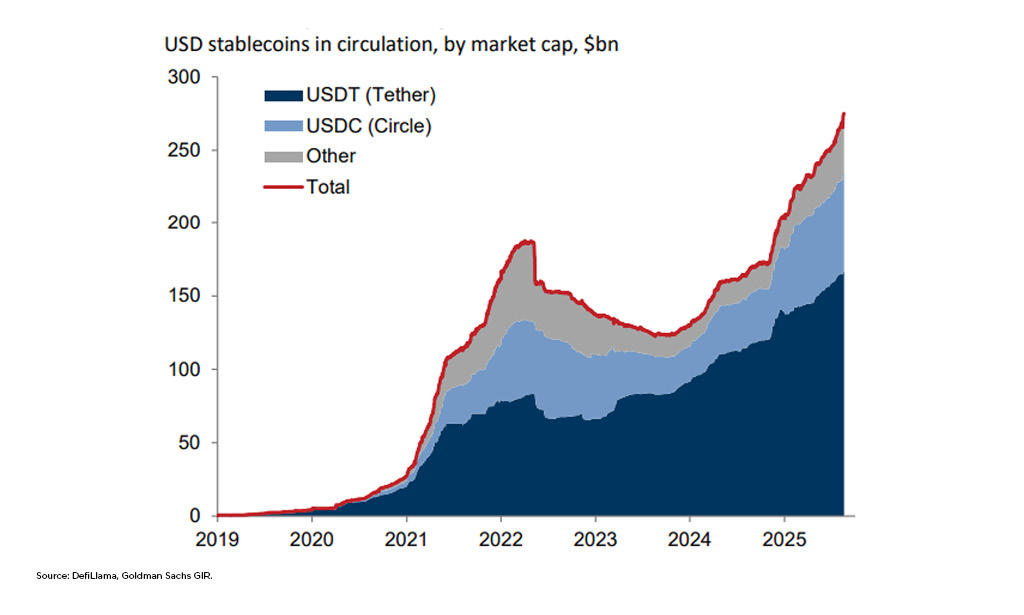

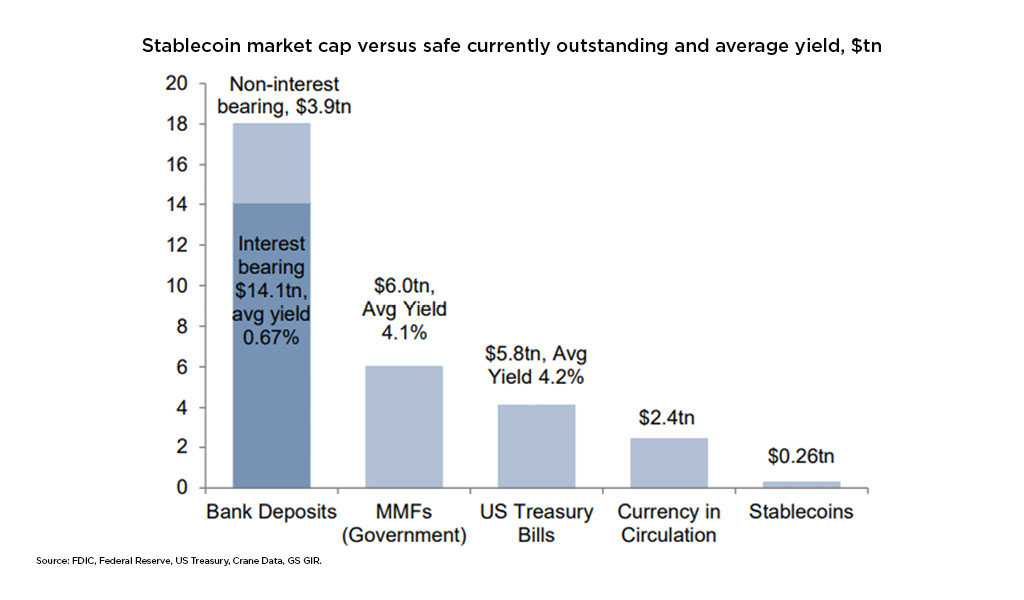

Stablecoins are close to $300bn in market cap and reportedly reached $28tn in transaction volume in 2024. The growth has been rapid but still pales in comparison to the scale of traditional finance alternatives to stablecoins, such as deposits and money market funds.

Tether (USDT) and Circle (USDC) make up 61% and 25% of the total market cap of stablecoins. USD stablecoins currently account for 99% of the total market cap.

Today’s use cases

Stablecoin market cap has grown primarily due to its use as a convenient means to move between fiat and crypto currencies (commonly referred to as on-and off-ramp).

There is increased focus on the potential to use stablecoins for global payments on the blockchain. Consumers and businesses could benefit from more efficient settlement than traditional finance payment rails. Greater adoption of stablecoins for payment will require coordinated global regulation as well as user-friendly transaction interfaces. This use case poses a threat to existing payment rails such as bank payment systems and cards.

A stable and well-regulated stablecoin industry could use the power of the blockchain to facilitate cross border payments at scale, both faster and at a lower cost than existing banking frameworks 24 hours a day, seven days a week.

An additional use case for stablecoins, particularly those pegged to the US dollar, is that they provide hard currency exposure for those operating in countries with volatile currencies. The stablecoin could then be used for savings or transactions, such as remittances.

It is worth noting that stablecoins do not, and in most cases are not permitted by regulation, to pay any yield / return. This has been consistently reflected in existing regulation across multiple jurisdictions to distinguish stablecoins as a digital payment instrument and not an investment product. As a result, stablecoins in their current form are not likely to supplant MMFs or interest-bearing deposits as a cash investment vehicle.

Risks presented by stablecoins

Stability of the underlying reserves: the risk that the reserves backing the stablecoin are not sufficient to maintain the peg value of the stablecoin which exposes the holder to the credit risk of the issuer (in some cases, unregulated fintech companies)

Run risk: even if reserves are sufficient, the stablecoin could still be liable to a run if they face mass redemptions alongside other market shocks. For example, Circle’s USDC de-pegged from the US dollar following the collapse of Silicon Valley Bank in 2023 with market rumours about stablecoin deposits held at the bank (falling to 88c before recovering to 96c).

Regulation: regulators are tackling this emerging industry in different ways.

Financial crime risk: Chainalysis, a firm that monitors blockchain activity, estimates that around $50bn was received by illicit wallet addresses in 2024, 63% of which was in the form of stablecoins. Regulators around the globe will need to grapple with these risks as part of the regulatory rollout.

Selected current regulation of stablecoins

US: The GENIUS Act passed in July 2025 establishes the US regulatory framework for payment stablecoins. It requires US regulated stablecoins to invest their reserves in high quality liquid assets such as money funds, Treasuries and bank deposits.

Europe: MiCA, a set of rules that came into effect at the end of 2024 covering the wider crypto industry, set out specific rules for stablecoins. Issuers must be regulated in Europe as a credit institution, or an electronic money institution and reserves have to be in deposits with European financial institutions (they may also be able to hold EUR government bonds but not immediately clear). EURC (Circle’s EUR stablecoin) is only €200m in size and is fully backed by bank deposits with no other assets held in reserve.

Hong Kong: Legislation came into effect in August 2025 to establish a regulatory regime for issuers of stablecoins in Hong Kong. Issuers must maintain a pool of reserve assets that must be “of high quality and high liquidity with minimal investment risks” with a market value that must always be at least equal to the outstanding value of the stablecoin. MMFs are permitted as stablecoin reserves under the guidance published by the HKMA.

UK: The UK crypto regulatory framework was released in 2023 with an intention to finalise this year. Crypto assets and stablecoins will be incorporated into existing financial regulation rather than creating bespoke regulation. There is no clarity yet on permitted types of reserve assets for stablecoins.

Tokenisation

Distributed ledger technology (DLT) has long been associated with cryptocurrencies and in particular Bitcoin. The blockchain is one form of DLT and other forms have emerged as the usage of the technology extends. The terminology of blockchain and DLT are often used interchangeably.

The DLT operates based on one single immutable record that has been verified by consensus across a decentralised network. In traditional systems, each participant in an ecosystem operates their own independent database and they undertake reconciliations of their own records to counterparts. The DLT moves away from that concept of individual databases at each firm to the concept of a single decentralised record that participants access via nodes on a network. Each allowed node can view and validate activity. This creates a single view for all participants and an immutable record eliminating the duplication of records prevalent in legacy technology.

Tokenisation is the process of converting the ownership of assets or rights (including financial assets, physical assets, and even intangible assets) into digital tokens on the DLT, enabling these assets to be traded or transferred in the form of tokens on a blockchain network. In the case of a mutual fund, each token could represent a whole fund unit / share or a fraction thereof. Transactions are processed on the DLT by means of “smart contracts”, self-executing computer programs that are integral to the token. The smart contract will complete any operational, compliance, tax or accounting rules required to process and validate a transaction.

The tokenisation of MMF units has emerged as an early and important use case in the broader market wide push to tokenise different asset classes. The characteristics of the DLT to increase portability, deliver almost instantaneous settlement and reduce operational friction have the power to enhance the experience of a MMF investor and enable new use cases in the future.

The ability to transfer on-chain currency reserves into a tokenised MMF will offer an investor a return on their holding that is not currently available elsewhere on-chain within the digital ecosystem.

Observed approaches to tokenisation to date

The approach to the tokenisation of funds is still evolving with different models emerging in response to different use cases and / or regulatory and legal constraints. While the DLT may eventually replace most participants in the value chain, the focus of efforts to date has been limited to the activities of the transfer agent (TA). All other forms of the fund administration process remain untouched.

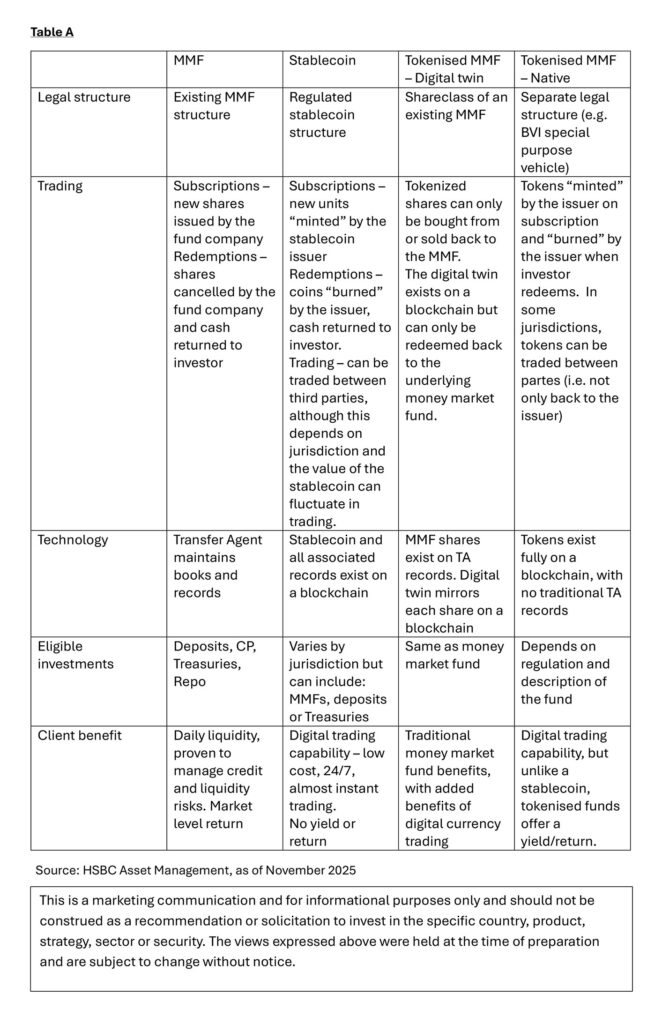

So far, two key approaches have emerged:

1. Digital twin (non-native tokenisation) – maintaining a digital record in parallel on the DLT

A token is created on the DLT that represents the ownership of the unit / share of a fund. Under this model, the fund still issues its units / shares in the traditional way, recording them on the analogue register at the TA, and the blockchain records an additional “mirror recording” or “twin” of that asset.

This has the benefit of leveraging the scale of existing funds while maintaining the safety and regulatory framework MMF investors require.

There is no change to the existing operation of the fund, its regulatory status or construct. Investors in the fund must complete all normal AML/KYC onboarding processes as they do today. It is worth noting that the AML / KYC process has not yet moved on-chain.

In the MMF industry, we have seen this approach deployed in several areas, the collateral use case (see section below) is the most prevalent to date. It is worth noting that although there is a lot of activity, the scale of AUM remains a small fraction of the overall MMF industry.

2. Digitally native tokenisation

Under this model the fund’s register is recorded completely on the DLT and the fund issues digital tokens rather than units / shares. Subscription / redemption transactions are settled on-chain with digital currency. They often offer the ability to move off-ramp. Regulators are taking a cautious approach and often require the fund to maintain a parallel analogue record.

Today’s use cases

Collateral: Collateral managers deploying the blockchain as their recordkeeping system of choice. Until recently, the early adopters in this space have been limited to private closed networks. The collateral manager typically operates an omnibus structure, akin to a fund / platform distributor, whereby they make one investment to the fund via the traditional analogue route. They track beneficial ownership of the underlying holders by creating tokens. The DLT enables instant transfer of tokens between collateral giver and receiver accounts in real time. The units at the TA are under the control of the collateral agent, as with any omnibus platform today, and they create or redeem units on a net basis. While collateral managers have built these solutions, we have yet to see broader take-up with most transactions limited to proof of concept.

Tokenisation agents: the MMF puts a distribution agreement in place with an agent who again often operates an omnibus account structure and uses the DLT to record the interests of the underlying beneficial owner.

Distribution networks: at least one technology provider has built a distribution network solution which effectively provides a token conversion tool for on-chain investors. An investor will onboard directly with the underlying fund in the same way they do today, and the TA will maintain their holding on the share register. The network provider translates the blockchain originated transaction to a traditional format accepted by a TA (Swift, flat file) effectively replicating the trading portals common in the MMF industry today. Again, a parallel record is maintained on the DLT by the network provider. This opens the opportunity for new customer segments and channels.

Third party vs issuer tokenisation: Most of the tokenisation to date has been implemented by third parties and not the managers or the funds themselves. There are various drivers for this, some are constrained by regulation in their jurisdiction, some may have a very narrow use case or see it as a valuable way to start their tokenisation journey. Regulatory clarity in Luxembourg has enabled one MMF manager to go as far as tokenising a share class of an existing fund although we understand this is again achieved through the maintenance of a parallel record.

Selected current regulation of tokenised funds

There continues to be a divergence in legislative and regulatory frameworks across the globe. European managers are approaching tokenisation cautiously, building experience slowly by working with third parties in the first instance. We have observed a number of smaller launches from smaller money managers in jurisdictions that have amended legislation to allow native tokenisation.

Ireland and Luxembourg are key jurisdictions for MMFs in Europe. Ireland has not yet progressed legislation to allow fund tokenisation and we understand there is little to no activity yet. By contrast, Luxembourg has been proactive in creating legislative and regulatory frameworks to facilitate the launch of digitally native funds. This enabled Franklin Templeton to launch the first natively tokenised UCITS MMF, regulated under European Money Fund regulation, in Luxembourg, in October 2024. There is no publicly available data on AUM but we understand this is small at approximately $10m.

Other European jurisdictions such as France and Germany have also progressed their frameworks. The AMF has authorised one MMF in France which is targeting crypto investors. Growth to date has been modest, and since its launch in 2024 the Spiko fund has grown to $114m.

Hong Kong and Singapore see digital enablement as a differentiating factor and have been proactive in opening sandboxes to facilitate the launch of digitally native funds. In Q4 2024 UBS and Standard Chartered & Wellington launched their own fully native funds in Singapore targeting web3.0 investors and the collateral use cases. Both funds have been working with Ondo Finance to offer off-ramp solutions. In February 2025, a Chinese asset manager, China AMC, launched an HKD Digital Money Market Fund in Hong Kong targeting retail customers. It has grown to HK$ 970m.

The US has seen little activity from managers to date with activity focused on collaborations with collateral platforms who are placing their collateral management processes on-chain operating the omnibus models highlighted earlier. The SEC still designates any instrument that is issued on the blockchain as a crypto asset security. Publicly registered funds are heavily intermediated by the Broker Dealers and they are prohibited from taking custody of a crypto based security which effectively blocks distribution of a tokenised fund. This may change quickly but at present we understand this is not a priority for the current administration. Consequently, US use cases for digitally native funds have focused on limited distribution of private funds, like BlackRock’s BUIDL, domiciled in the British Virgin Islands.

Summary

Distributed ledger technology represents an opportunity to revisit the way in which treasurers can invest their surplus funds in line with their board approved risk appetites. It offers significant savings in costs, reduced FTE effort, improved risk management and controls (while recognising the emergence of new risks), reduced counterparty risks, faster settlement and greater transparency. We expect a gradual progression in fund tokenisation as confidence in the technology grows and participation increases.

From a money market fund user perspective, the ability to move (transfer, trade, pledge) units without necessarily redeeming offers significant advantages. Their use as collateral pledged to third parties but also intercompany transfers can only enhance the utility of a money fund holding.

We have yet to see scale solutions for the custody of wallets that will keep secure the DLT private keys necessary to secure the holding for institutional investors. For these reasons, we anticipate it will take some time to reach a point where the full advantages of DLT can be harnessed.

There is also a way to go before AML / KYC processes and controls can move on-chain to the satisfaction of risk managers and regulators. At present, liquidating a holding requires the token holder to return the token to the fund or the platform provider.

Another impediment is the lack of regulatory clarity and consistency in approach is driving multiple different routes which we expect to continue for the foreseeable future.

So, while for most treasurers, the use of DLT products remains theoretical, there is a growing number actively exploring them (and in fact a few using them). As such, it is important for treasurers to understand the technology and terminology and to keep abreast of developments in this sector so that they are ready to engage with the market when they feel it is appropriate.